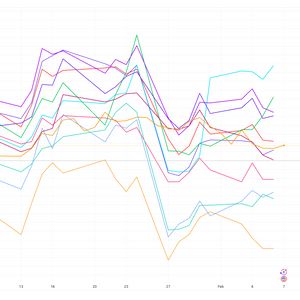

Analysts now suggest that this move is a result of the changing leadership at the SEC, which has historically ignored Solana ETF filings and classified SOL as a security. Meanwhile, the Cboe BZX Exchange also filed applications for spot XRP ETFs on behalf of major asset managers. Additionally, Franklin Templeton has joined the ETF race by filing for a multi-asset crypto index fund combining Bitcoin and Ethereum exposure. SEC Opens Door for Spot Solana ETF The United States Securities and Exchange Commission (SEC) took a big step toward approving a spot Solana exchange-traded fund (ETF) after acknowledging Grayscale’s amended application . This is the first time the SEC moved forward with a Solana ETF filing. Bloomberg ETF analyst James Seyffart pointed out this milestone, and mentioned that previous filing attempts for Solana ETFs were completely ignored by the regulator. Fellow Bloomberg analyst Eric Balchunas agreed , and described the move as a ”notable” step, albeit a small one, but one that seems to be influenced by recent leadership changes at the SEC. Historically, the SEC refused to consider spot Solana ETF applications under the leadership of former Chair Gary Gensler, as the regulator classified Solana as a security rather than a commodity. This stance was reinforced by ongoing lawsuits against major cryptocurrency exchanges like Binance and Coinbase, which the SEC has accused of trading unregistered securities, including Solana. Seyffart previously estimated that it could even take until 2026 for a Solana ETF to get approval. The recent acknowledgment of Grayscale’s application, however, suggests that there is a potential shift in the SEC’s approach, though the final deadline for the regulator to rule on Grayscale’s ETF is set for Oct. 11. The SEC has been flooded with cryptocurrency ETF applications over the past few weeks as issuers test the regulatory waters under the current leadership of Commissioner Mark Uyeda. Alongside Grayscale, firms like 21Shares, Bitwise, VanEck, and Canary Capital also submitted filings for spot Solana ETFs through the Cboe BZX Exchange. In addition to Solana, Bitwise put forward a proposal for a spot Dogecoin ETF. For now, Litecoin seems to be the next cryptocurrency likely to secure SEC approval for a spot ETF. On Feb. 6, the SEC acknowledged Grayscale’s filing for a Litecoin ETF, which is a move that Seyffart believes puts Litecoin next in line after Bitcoin and Ethereum. Bloomberg analysts base this expectation on the fact that Canary’s S-1 filing for a spot Litecoin ETF is already under active regulatory review , whereas applicants for other cryptocurrency ETFs still have to reach this stage. If approved, a spot Solana ETF could attract a lot of investor interest. JPMorgan estimated that these ETFs could amass between $3 billion and $6 billion in net assets in its first year. Balchunas described this projection as a reasonable estimate, given the strong demand for crypto-based investment products. Solana ETF approval odds on Polymarket Meanwhile, the predictions market platform Polymarket currently places the odds of a spot Solana ETF gaining SEC approval before July 31 at 39%. While the road to approval is still uncertain, the latest developments suggest that the prospect of a spot Solana ETF is now closer than ever before. XRP ETF Filings Gain Momentum Cboe BZX Exchange also recently filed 19b-4 applications on behalf of four asset managers to launch the first spot XRP ETFs in the United States. The filings were submitted on Feb. 6, and represent Canary Capital , WisdomTree , 21Shares , and Bitwise , who are all looking to offer ETFs that track the price of XRP. These filings serve as official notifications to the SEC regarding proposed rule changes and, if approved, would be the introduction of XRP ETFs in the US market. Under the leadership of former Chair Gary Gensler, the SEC already approved ETFs tracking Bitcoin and Ethereum, and allowed them to begin trading in early 2024. However, the regulatory landscape has seen quite a shift with crypto-friendly leadership taking the helm. Bitwise was the first to submit a Form S-1 registration statement for an XRP ETF in October last year, which is an essential requirement alongside a 19b-4 filing for an ETF to be approved. Shortly afterward, Canary Capital followed with a Form S-1 for its Canary XRP Trust. Additional applications came in from 21Shares in November for the 21Shares Core XRP Trust and from WisdomTree in December for its WisdomTree XRP Fund. On Jan. 30, NYSE Arca, a subsidiary of the New York Stock Exchange, also filed a 19b-4 application to convert Grayscale’s existing XRP trust into a spot ETF. Jersey-based asset manager CoinShares joined the race on Jan. 24 by submitting a Form S-1 for a CoinShares XRP ETF. JPMorgan also projected strong investor demand for these financial products, and estimated that spot XRP ETFs could attract between $4 billion and $8 billion in net new assets in their first year. Meanwhile, XRP is currently trading at approximately $2.36 after its price dropped by about 2.29% over the past 24 hours of trading. Franklin Templeton Files for Crypto Index ETF Franklin Templeton added to the growing list of ETF application after filing an application with the SEC to launch a multi-asset cryptocurrency ETF. If approved, the Franklin Crypto Index ETF will provide investors with exposure to the spot prices of Bitcoin and Ethereum in a single fund, with assets weighted by their respective market capitalizations. According to the filing that was submitted on Feb. 6, the ETF will be listed on the Cboe BZX Exchange. The fund’s composition on the filing date was 86.31% Bitcoin and 13.69% Etherem, with the index set to be rebalanced and reconstituted quarterly in March, June, September, and December. Franklin Templeton’s move follows a similar filing from Bitwise on Jan. 31 for its Bitwise Bitcoin and Ethereum ETF. Proportion split (Source: SEC ) The firm mentioned that additional cryptocurrencies could be included in the Franklin Crypto Index ETF in the future, but only if both the fund and the Cboe BZX Exchange receive the necessary regulatory approvals to expand beyond Bitcoin and Ethereum. However, the filing made it clear that there is no guarantee that any other digital assets will be permitted for inclusion. The filing also outlined several risks for investors, particularly the potential impact of competition from other cryptocurrencies like Solana, Avalanche, and Cardano. The firm warned that the growth of alternative digital assets could reduce demand for the Franklin Crypto Index ETF. With Bitcoin and Ethereum ETFs already in place, multi-asset funds will be the next phase in integrating digital assets into traditional financial markets. However, the SEC’s stance on further approvals is still uncertain.