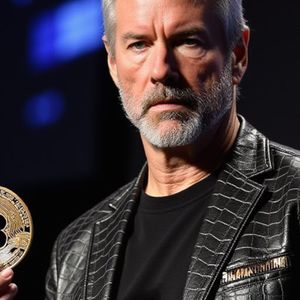

Tightening liquidity in financial markets has sparked interest in XRP, with analysts suggesting it may hold the key to alleviating this issue. According to some experts, the rising adoption of XRP for settlements and cross-border transactions may drive up its price. Role in Addressing Liquidity Shortages Versan Aljarrah, the founder of Black Swan Capitalist, recently highlighted concerns about a growing settlement gap affecting banks and financial institutions. In a recent statement, he pointed out that global liquidity constraints are making it more difficult for traditional financial systems to process transactions efficiently. He argues that XRP, with its real-time settlement capabilities, could provide a solution. XRP is designed to facilitate instant and cost-effective transactions, particularly in cross-border payments. Aljarrah suggests that as traditional liquidity sources shrink, financial institutions may increasingly turn to XRP as an alternative. He believes increased demand could directly influence the token’s price, propelling it upward as institutions integrate the asset into their payment infrastructure. Further reinforcing his viewpoint, Aljarrah emphasized that XRP is not just another cryptocurrency but a critical component in the global financial system. His argument aligns with sentiments from other proponents, such as financial mentor Linda Jones , who has compared holding XRP to investing in early Berkshire Hathaway stocks. Speculative Price Projections for the Token’s Future Value Discussions about the token’s long-term value continue, with some analysts making bold predictions. One such figure, Chad Steingraber, has suggested that the asset could reach as high as $20,000 per token, citing institutional demand as a key driver. According to Steingraber, a potential scenario unfolds when XRP becomes a reserve asset for top financial institutions. In this scenario, major banks like JPMorgan and Bank of America utilize private ledgers based on XRP technology to facilitate secure and efficient transactions. He speculates that institutional liquidity providers could increase demand by holding large XRP reserves. We are on twitter, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) July 15, 2023 Additionally, he proposes that a sudden surge in bank acquisitions of XRP could lead to a supply shock, reducing the publicly available supply to levels comparable to Bitcoin’s 21 million token limit. In this scenario, limited availability and high institutional demand could propel the token’s price to unprecedented levels. Reality Check: Can XRP Reach Such High Valuations? While these predictions highlight the potential impact of institutional adoption, it is important to consider the underlying principles. The idea of XRP becoming a dominant reserve asset or experiencing a drastic supply reduction remains speculative. Despite the enthusiasm from some analysts, achieving a price of $20,000 per token would require a dramatic shift in global financial infrastructure and widespread institutional adoption. XRP’s future remains closely tied to developments in regulatory policies and institutional interest. While XRP’s role in cross-border payments continues to grow, it remains uncertain if it will reach such high valuations remains uncertain. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Expert Reveals What Would Boost XRP Price Amid Liquidity Crisis appeared first on Times Tabloid .