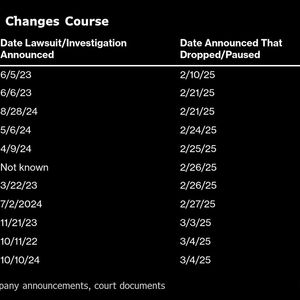

The U.S. federal government has sold approximately 195,000 Bitcoin over the past decade, generating an estimated $366 million from criminal seizures, including those linked to Silk Road. American taxpayers have missed out on $17 billion in Bitcoin ( BTC ) profits since 2013 due to a walled garden investment strategy adopted by previous administrations, White House AI and Crypto Czar David Sacks opined via X. Sacks shared a Federal Government Bitcoin Sales Analysis, generated by Elon Musk-backed Grok AI, in what appears to be another hint of a potential U.S. crypto reserve under President Donald Trump. The U.S. government began seizing Bitcoin in 2013, with the FBI’s confiscation of 11 BTC marking the first recorded instance of an American agency taking control of the asset. Public records indicate that the Bitcoin was seized from a bad actor attempting to buy illegal drugs. Since then, the FBI and other law enforcement agencies have confiscated approximately 195,000 BTC. Data shows that the U.S. government sold Bitcoin 11 times over the past 12 years, with 173,000 BTC liquidated by November 2015 in four major sales over three years. You might also like: Is Trump’s crypto strategic reserve just a front to pump WLFI and his own bags? That cache alone would be worth over $15 billion as BTC cost $89,800 per token on March 6. “If the government had held the Bitcoin, it would be worth over $17 billion today,” Sack said, implying the government paper-handed crypto wealth. A paper-hand investor is one who sold an asset early and missed its biggest price run. Authorities have 207,000 BTC left in public coffers, which could transition into a national stockpile or form the foundation for a U.S. crypto reserve. President Trump’s January Executive Order directed his crypto cabinet and regulators like the Securities and Exchange Commission to develop BTC reserve legislation, bolstering industry hopes. Further remarks from Trump about mixing BTC with altcoins in a reserve split a divide among his crypto and tech-heavy Silicon Valley supporters. Still, Trump will presumably announce a BTC reserve strategy at the first White Crypto Summit on March 7. The asset revisited $90,000 price levels ahead of the event as market volatility swayed spot prices. Over the past decade, the federal government sold approximately 195,000 bitcoin for proceeds of $366 million. If the government had held the bitcoin, it would be worth over $17 billion today. That’s how much it has cost American taxpayers not to have a long-term strategy. — David Sacks (@davidsacks47) March 6, 2025 Read more: News Trump to announce Bitcoin reserve strategy at White House Crypto Summit: report