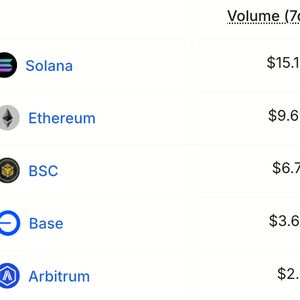

United States asset manager Canary Capital has filed to list an exchange-traded fund (ETF) holding the Tron blockchain network’s native token, TRX ( TRX ), regulatory filings show. The fund intends to hold spot TRX and stake a portion of the tokens for added yield, the filing said . According to CoinMarketCap, the TRX token has a total market capitalization of more than $22 billion. Staking TRX generates an annualized yield of approximately 4.5%, data from Stakingrewards.com shows . The filing is the latest in an outpouring of submissions aimed at listing ETFs holding alternative cryptocurrencies, or “altcoins.” However, Canary’s proposed fund is relatively unique in requesting permission to stake its crypto holdings in its initial application. Other US ETFs, such as those holding the Ethereum network’s native token, Ether ( ETH ), have sought approval for staking only after successfully listing a fund holding the spot token. They are still waiting for a regulatory decision. Tron is a proof-of-stake blockchain network founded by Justin Sun, who also owns Rainberry (formerly Bittorrent), the developer of the BitTorrent protocol. In March 2023, the SEC sued Sun for allegedly fraudulently inflating the prices of the Tron token and BitTorrent’s BTT token. In February, the SEC and Sun asked the judge overseeing the lawsuit to pause the case to allow the parties to enter into settlement talks. Platforms for staking TRX. Source: Stakingrewards.com Related: Canary Capital proposes first Sui ETF in US SEC filing Altcoin ETF season Since US President Donald Trump took office in January, US regulators have acknowledged dozens of filings for proposed crypto investment products. They include plans for ETFs holding native layer-1 tokens such as Solana ( SOL ) as well as memecoins such as Official Trump (TRUMP). Since 2024, Canary has filed for several proposed US crypto ETFs, including funds holding Litecoin ( LTC ), XRP ( XRP ), Hedera ( HBAR ), Axelar (AXL), Pengu (PENGU), and Sui ( SUI ). Some industry analysts doubt that ETFs holding non-core cryptocurrencies will be embraced by traditional investors. “Most crypto ETFs will fail to attract AUM and cost issuers money,” crypto researcher Alex Krüger said in a March post on the X platform. Magazine: SEC’s U-turn on crypto leaves key questions unanswered