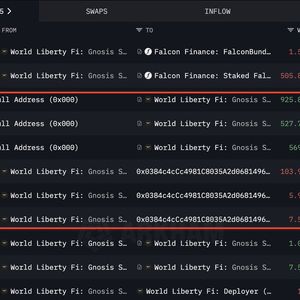

XRP has continued to struggle despite Ripple’s long-awaited legal win against the U.S. Securities and Exchange Commission (SEC), multiple spot ETF filings, and major business strides. Notably, the coin’s muted response to the March 2025 dismissal of the SEC lawsuit has raised concerns within the crypto community, with one prominent pundit claiming the damage runs deeper than price charts can show. “All Things XRP,” a popular influencer in the XRP community, recently sparked this conversation, blaming the SEC for not just slowing XRP down but stealing its years of growth, all while other crypto assets like BTC, ETH, and SOL soared. The post referred to the lawsuit filed by the SEC in December 2020, which accused Ripple Labs of conducting an unregistered securities offering. The impact was immediate and brutal with XRP’s price plunging from $0.65 to $0.17 in a matter of days, marking a 73% crash. Major U.S. exchanges including Coinbase and Kraken delisted the coin, effectively cutting off access for American investors and collapsing its liquidity. “The lawsuit didn’t just hit the price. It painted XRP as “toxic.” Banks paused. Institutions bailed. Investors lost faith. Even post-victory, that stigma lingers,” he noted . The pundit further reminded his followers that for the next three years, XRP was trapped in regulatory limbo. From 2021 to 2023, while Bitcoin, Ethereum, and Solana rallied during the bull market, XRP remained flat, trading between $0.30 and $0.50. The lawsuit suppressed price action and drained investor interest and institutional confidence. “Retail FOMO couldn’t reach it,” the pundit wrote . “U.S. buyers were locked out. Total price suppression.” However, he noted a brief glimmer of hope in July 2023, when Judge Analisa Torres ruled that XRP was not a security when sold on exchanges to retail buyers. The price doubled overnight to $0.84, but the celebration was short-lived. The SEC filed an appeal, casting a fresh shadow of doubt and halting XRP’s momentum once again. When the SEC finally dropped the case in March 2025, XRP jumped to $2.49. But instead of a euphoric rally, the response was underwhelming. The broader market had moved on, and XRP’s reputation had taken a lasting hit. According to the pundit, the true cost for XRP hasn’t just been legal fees but the missed opportunities. He emphasized that Ripple had the potential to lead the way in blockchain-powered cross-border payments. Instead, years were squandered in courtroom battles while competitors surged ahead. He further argued that the biggest challenge facing XRP today isn’t the SEC. “XRP’s biggest problem now isn’t the SEC — it’s apathy,” he said, before offering a note of optimism. He believes that ETF applications, the upcoming launch of the RLUSD stablecoin, and a renewed focus on institutional partnerships could give XRP the foundation to rally alongside other crypto assets in the next bull market, especially now that much of its regulatory baggage is behind it.