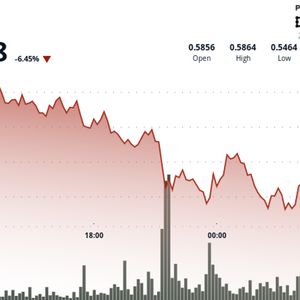

Cardano (ADA) ADA is trading at $0.5478, down 6.45% over the past 24 hours, after a sharp correction fueled by market anxiety surrounding escalating geopolitical conflict in the Middle East. The token fell from a high of $0.586 to a low of $0.5464, with the steepest drop occurring during the 21:00 hour when ADA fell 3.2% on 126 million volume, according to CoinDesk Research's technical analysis model. 24-hour trading volume climbed to 37.37% above its 30-day average. Despite this volatility, Cardano continues to attract long-term interest. Nearly $1 billion worth of ADA has been withdrawn from centralized exchanges in 2024, and over 310 million tokens have been accumulated by large holders in June alone. Institutional interest in the Cardano ecosystem was also underscored this week by the launch of a new proof-of-concept initiative involving decentralized storage platform Iagon, legal tech firm Cloud Court, and Ford Motor Company. The pilot project aims to test the viability of combining Cardano’s blockchain infrastructure with Iagon’s decentralized cloud storage to support secure legal data management systems. Ford is contributing to the project in an advisory role, drawing on its internal experience managing large-scale legal data operations. The initiative is designed to explore how a hybrid architecture—where sensitive legal documents are encrypted and stored off-chain, and access logs and verification are handled on-chain—might address long-standing issues like fragmented records, inefficient collaboration, and lack of auditability. The project also reflects Cardano’s expanding presence in enterprise environments, with potential applications extending to sectors such as healthcare, finance, and public administration. Technical Analysis Highlights ADA declined 7.0% from $0.586 to $0.545 during the analysis window, forming a $0.041 range. The steepest intraday move occurred during the analysis window, marked by a 3.2% hourly decline and elevated volume. A high-volume resistance level formed at $0.569, while support was tested at $0.545. Recovery attempts during the 23:00 and 00:00 hours failed to break resistance, despite volume exceeding 60 million ADA. A descending channel with lower highs and lower lows confirmed the bearish structure. Between 06:05 and 06:38, price entered a bullish channel with a sequence of higher lows and higher highs. Resistance emerged at $0.558, and a support zone developed around $0.554. Volume peaked at 2.3 million ADA during the 06:16 candle, supporting a temporary upward move. A modest pullback from $0.558 to $0.556 followed, representing typical post-rally consolidation. Volume declined during the pullback, suggesting weakening selling momentum. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .