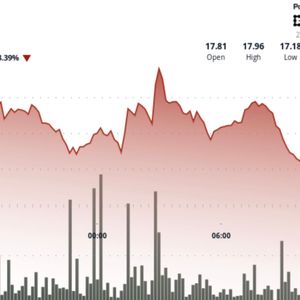

During the U.S. session, Bitcoin is trading with a bullish bias at around $107,411, gaining nearly 1.5% over the last 24 hours. BTC received a fresh jolt this week as SoFi announced its return to the crypto trading space, sending a strong signal of renewed institutional interest. SoFi, a San Francisco-based financial platform, is planning to relaunch Bitcoin (BTC) and Ethereum (ETH) trading later this year. Additionally, it is also likely to add more features, including crypto-backed loans, staking, and support for stablecoins. A comeback with this marks a significant turnaround from its 2023 exit from crypto services. $SOFI is rolling out new crypto-enabled features later this year, including self-serve international money transfers and the return of crypto investing. Members will be able to send money abroad faster and cheaper using blockchain, with real-time transparency on fees and FX.… pic.twitter.com/EvNNJabpxz — Wall St Engine (@wallstengine) June 25, 2025 CEO Anthony Noto emphasized that blockchain will play a central role in SoFi’s future product suite. SoFi, already holding a BitLicense in New York, is aiming to become a full-service crypto bank amid a more favorable U.S. regulatory landscape under the Trump administration. SoFi to offer Bitcoin, Ethereum, staking & loans Blockchain to power broader SoFi platform Move follows regulatory clarity from OCC Bitcoin’s price jumped toward $107,500 as traders welcomed the return of a major U.S. fintech to the space. NYSE Files Rule for Trump-Backed BTC-ETH ETF Adding to the bullish tone, the New York Stock Exchange filed to list a new ETF called the “Truth Social Bitcoin and Ethereum ETF,” backed by Trump Media and Yorkville America. The fund would allocate 75% to Bitcoin and 25% to Ethereum, with Crypto.com serving as custodian and liquidity provider. BREAKING NEWS #Trump 's Truth Social files for Bitcoin & Ethereum ETF with NYSE. pic.twitter.com/4KVmA4DChX — Wise Advice (@wiseadvicesumit) June 25, 2025 While SEC approval is still pending, the move is viewed as a strategic step by Trump Media to align with pro-crypto sentiment. The filing landed just days after a separate ETF prospectus, signaling an aggressive push for crypto product offerings. ETF to hold 75% BTC, 25% ETH Crypto.com tapped as custodian Trump Media strengthens crypto ties The announcement helped Bitcoin hold above $107,000, bolstered by expectations of broader market acceptance. Bitcoin ETFs See $588M Inflows, Support Rally Spot Bitcoin ETFs recorded their strongest daily inflow in weeks on Tuesday, with $588.6 million entering U.S. funds. BlackRock’s IBIT led the charge with $436.3 million, followed by Fidelity’s FBTC with $217.6 million. Meanwhile, Grayscale’s GBTC saw $85.2 million in outflows. Momentum in crypto ETFs isn’t letting up. Bitcoin ETFs scored their 11th straight day of inflows on June 24, pulling in $588.55M with @BlackRock ’s IBIT soaking up a massive $436.32M Ether ETFs also stayed green with $71.24M. Bullish or overheated? Let us know! — Bitcoin.com News (@BTCTN) June 25, 2025 This marked the 11th straight day of net inflows into spot ETFs and came amid a ceasefire between Israel and Iran, which helped de-risk broader markets. Analysts say ETF inflows are now the dominant driver of short-term BTC price movements, showing a strong correlation to price performance. BlackRock and Fidelity absorb most flows ETFs post 11-day inflow streak Ceasefire eases macro pressure With Bitcoin bouncing from $98,000 lows to over $107,000, analysts note that investor perception of BTC as “digital gold” continues to strengthen. Technical Setup: Bulls Hold $107K, Eye $108,740 Breakout BTC/USD is consolidating just under $108,740 after breaking above a multi-week descending trendline near $106,800. The MACD remains bullish but is flattening, signaling a pause in momentum. Bitcoin price chart – Source: Tradingview Breakout Entry: Above $108,740 Targets: $110,490 and $112,080 Pullback Buy Zone: $106,800 to $105,100 A confirmed move above $108,740 could spark the next leg higher. But for now, traders are watching volume and candle structure closely to gauge the breakout’s validity. Bitcoin Hyper Presale Surges Past $1.6M—Layer 2 Just Got a Meme-Sized Boost Bitcoin Hyper ($HYPER) has smashed through the $1.6 million milestone in its public presale, raising $1,608,571 out of a $1,831,658 target. With just hours left before the next price tier, buyers can still secure HYPER at $0.012025 per token. As the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), Bitcoin Hyper delivers fast, low-cost smart contracts to the BTC network. It combines Bitcoin’s security with SVM’s scalability, enabling high-speed dApps, meme coins, and payments—all with ultra-low gas fees and seamless BTC bridging. Audited by Consult, Bitcoin Hyper is built for trust, scale, and performance. Over 109 million $HYPER are already staked, with projected post-launch staking rewards of up to 480% APY. The token fuels gas fees, dApp access, and decentralized governance. The presale accepts both crypto and cards, and through Web3Payments, no wallet is required. Meme culture meets utility, Bitcoin Hyper is quickly emerging as Layer 2’s potential breakout star of 2025. The post Bitcoin Price Prediction: Skyrockets Past $107K as SoFi Energizes Crypto Market and NYSE Unveils Trump ETF appeared first on Cryptonews .

![[LIVE] Pi Coin Price Prediction: Chainlink–Mastercard Hype Fuels Huge Rally – Is This the Start of Mass Adoption? [LIVE] Pi Coin Price Prediction: Chainlink–Mastercard Hype Fuels Huge Rally – Is This the Start of Mass Adoption?](https://resources.cryptocompare.com/news/52/46828832.jpeg)