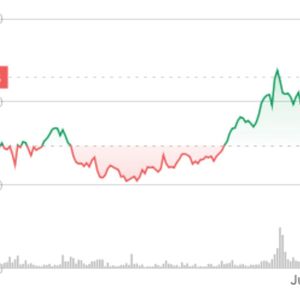

Japanese investment company Metaplanet has taken another big step in its Bitcoin (BTC) strategy. In a recent X post , the firm revealed it had purchased an additional 2,205 BTC, worth about $238.7 million. This new purchase has pushed Metaplanet’s total crypto holdings to 15,555 BTC. This move reflects both the company’s ongoing commitment to Bitcoin and a growing trend among institutional investors. Metaplanet’s Bitcoin Bet Pays Off, Sees Revenue Jumps in Q2 The latest acquisition, bought at an average price of $108,237 per coin, places Metaplanet as the fifth-largest publicly listed company holding the top coin. Meanwhile, U.S.-based software intelligence firm Strategy is topping the list, now owning more than 597,000 BTC. Metaplanet’s focus on building its business around the flagship crypto has shown strong financial results. In Q2 2025, the company reported revenue of nearly 1.1 billion Japanese yen, equal to about $7.6 million. This figure represents a 42.4% increase compared to the second quarter of 2024. The company states that its goal is to develop a business model that is long-lasting, easily scalable, and efficient to manage, utilizing Bitcoin as its financial foundation. This recent revenue growth indicates that its plan is gaining momentum and attracting attention from both investors and the broader financial market. Metaplanet Sets Ambitious Bitcoin Goal In June, Metaplanet updated its long-term goal for its crypto holdings. The company now aims to own over 210,000 BTC by the end of the year 2027. This is a major target and signals the company’s strong belief in the future value and importance of the digital coin in the global financial system. If Metaplanet reaches this goal, it would become one of the largest institutional holders of Bitcoin globally. This would place it in a very strong position within the fast-growing world of digital assets. Metaplanet’s ongoing Bitcoin strategy reflects a broader growing trend. Many companies are increasingly treating the top coin not just as an investment, but as a strategic asset. Earlier today, Semsler Scientific purchased 187 BTC for approximately $ 20 million, bringing its total Bitcoin holdings to 4,636. Firms like Tether-backed Twenty-First, GameStop, and Trump Media are also among the new entrants following this trend. Market Reaction and Stock Performance Following this news, Metaplanet stock dipped by 1.8% while the market remained open, according to Yahoo Finance data. Despite the slight drop, the company’s share price has performed very well over the past several months. In the past month, Metaplanet’s stock has gone up by almost 14% and has jumped by 339% since the start of the year. This substantial rise indicates that investors are confident in Metaplanet’s focus on Bitcoin. It also means they trust the company to grow and handle its investments carefully. The post Metaplanet Expands Bitcoin Holdings With New $239M Purchase appeared first on TheCoinrise.com .