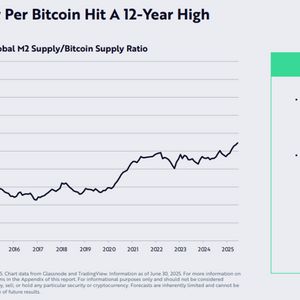

The People’s Bank of China (PBOC) has reportedly reached out to financial institutions in recent days to assess market sentiment surrounding the ongoing weakness of the U.S. dollar. According to people familiar with the matter cited by Reuters, the PBOC sent out an informal survey last week, probing for opinions on why the dollar has been slipping, how long the trend might last, and what it could mean for the Chinese yuan. The act signals that Beijing may be growing uneasy about the yuan’s recent gains against the faltering dollar and the potential knock-on effects on Chinese exports. The yuan has steadied while the dollar slumps The U.S. dollar has had a bruising 2025. The Dollar Index, which tracks the greenback against six major currencies, has fallen 11% so far this year, its worst start since 1973. Since early April when President Donald Trump announced a broad freeze on tariffs, the dollar has tumbled 6.6% as markets began pricing in looser U.S. trade and fiscal policies. In contrast, China’s yuan has held relatively steady, gaining about 1.3% over the same period. That’s good news for consumers and importers, but not so much for Chinese exporters who suddenly find their goods more expensive on the global market, just when they need every edge in a slowing economy. The dollar’s decline has now put the PBOC in a delicate spot . On the one hand, a stronger yuan helps reduce imported inflation and reinforces Beijing’s image as a steady hand in global finance. On the other, it could squeeze manufacturers and exporters, especially as the country tries to revive growth after a bumpy few years. The PBOC has long preferred stability over sharp moves, and its governor, Pan Gongsheng said earlier this year that keeping the yuan “reasonably stable” is essential for both domestic and global confidence. The survey could be a precursor to policy action The survey alone doesn’t signal immediate policy change, but it could be a first step. In similar situations in the past, the PBOC has used subtle levers to manage the yuan’s value without direct intervention. In April , the central bank reportedly nudged state-owned banks to curb dollar buying, a move many saw as a quiet way of putting a floor under the yuan. Most analysts believe the PBOC is unlikely to intervene unless the yuan strengthens dramatically. But the timing of this latest outreach has raised eyebrows. It comes just days before the expiration of Trump’s 90-day global tariff pause, set to end on Wednesday, July 10, and just a month ahead of the expiration of separate U.S. tariffs on Chinese tech imports. KEY Difference Wire helps crypto brands break through and dominate headlines fast