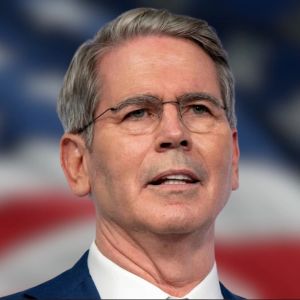

Scott Bessent, the US Treasury Secretary, finished a two-day negotiation marathon with Chinese Vice Premier He Lifeng in Geneva on Sunday, landing what he called “substantial progress” in a deal meant to tone down the aggressive trade war between the two countries. The negotiations involved top economic officials from both sides and wrapped with no press questions taken and no public deal terms—yet. Bessent told reporters that full details will drop Monday. He said President Donald Trump had been briefed throughout and was “fully aware” of the agreement reached. The discussions included US Trade Representative Jamieson Greer, who sat with Bessent and He alongside two unnamed Chinese vice ministers. Greer described the outcome as “a deal we struck with our Chinese partners,” claiming it would help reduce the $1.2 trillion US global goods trade deficit. He said both sides got through the key sticking points faster than expected. “It’s important to understand how quickly we were able to come to an agreement, which reflects that perhaps the differences were not so large as maybe thought,” Greer added. He also said the Chinese team was “tough negotiators.” White House and Commerce back the direction The meeting in Geneva was the first time Bessent, Greer, and He had met in person since Washington and Beijing hit each other with tariffs of over 100%. The deal marks a possible shift in that tariff war , though Bessent did not confirm any actual changes to the current rates. He did repeat his earlier stance that the tariffs were too high and needed to come down, but avoided giving direct answers about what had been agreed. Kevin Hassett, White House economic adviser, said on Fox News that the Chinese were “very, very eager” to hold the talks and fix their trade relationship with the United States. Hassett also said that deals with other countries could be announced as early as this week. Trump posted his reaction overnight on Truth Social, calling the talks a “total reset” done “in a friendly, but constructive, manner.” The president also said: “Many things discussed, much agreed to,” and added, “We want to see, for the good of both China and the US, an opening up of China to American business. GREAT PROGRESS MADE!!!” While the trade talks were happening, Commerce Secretary Howard Lutnick also joined his colleagues to announce that the 10% baseline tariff on imports from other countries would stay for now. “We do expect a 10% baseline tariff to be in place for the foreseeable future,” Howard said on State of the Union . Howard pushed back on the idea that the tariffs would raise prices for US shoppers. “Business and countries will pay,” he said, rejecting the idea that Americans would bear the costs. But recent trends tell a different story. Since Trump’s April 2 tariff announcement, consumer confidence has dropped and prices on some household items have already gone up. Businesses appear to be pushing some of the cost to buyers. Howard didn’t mention that. He only said that US producers would have the edge. “Businesses, their job is to try to sell to the American consumer, and domestically produced products are not going to have that tariff, so the foreigners are going to finally have to compete,” he said. This whole deal, while still mostly under wraps, came together fast. It involved real negotiations. Real stakes. And it put Bessent right in the center of something that could shape US-China economic ties going forward. All eyes are now on Monday. Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now