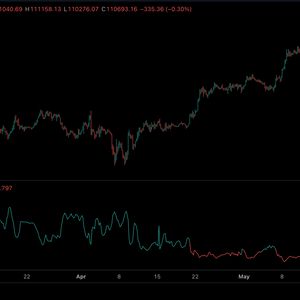

Summary BITW offers investors exposure to 10 cryptocurrencies in a simple 'diversified' fund. The fund has a large allocation to Bitcoin, which could hurt returns if a true 'altseason' were to manifest. At 2.5%, the fund has a high expense ratio and doesn't stake any of the PoS assets under management, producing an opportunity cost relative to holding the assets directly. The top 4 assets make up over 97% of the fund's capital; none of those 4 assets are 'cheap' in my view. At a 14% discount to NAV, BITW could serve as a potential arbitrage trade if/when more spot ETFs cover the crypto market in the US. I've covered the Bitwise 10 Crypto Index Fund ETF (BITW) for Seeking Alpha four times going back to 2023. My general thinking on the fund can be summed up in this way; I like it slightly better than its closest peer, the Grayscale Digital Large Cap Fund ETF (GDLC) because of a broader offering of assets, but I don't think it's the best way to play a rally in the altcoin market at this juncture. While the fund can occasionally serve as an interesting arbitrage opportunity when it trades a steep discount to net asset value, there are disadvantages with both the fund and its construction. In this update, we'll briefly review some of the pros and cons to holding BITW shares, as well as assess how I view the current valuation setup for the fund's top 4 holdings. Pros and Cons of BITW For speculators who want simple exposure to the digital assets in a single ticker, BITW works fine. As I see it, these are the top advantages of BITW over something like GDLC: BITW GDLC AUM $1.44b $775m NAV Per Share $70.90 $48.81 Market Price $60.83 $42.40 Discount to NAV 14.2% 13.1% BTC Weighting 78.0% 79.5% Fund Holdings 10 5 Sources: Grayscale and Bitwise as of May 20th Closing Prices Not only does BITW have a slightly bigger discount to NAV at 14.2% currently, but the fund also offers exposure to more assets than GDLC and has slightly less reliance on BTC for fund performance. With roughly double the AUM than that of GDLC, BITW has strong liquidity and gets a 'B+' liquidity grade from Seeking Alpha. As I see it, there are three important disadvantages to holding a fund like BITW over alternatives; expense ratio, asset weighting, and opportunity cost. At a 2.5% expense ratio, BITW is way too expensive for what is essentially a passively managed fund that is nearly 80% Bitcoin ( BTC-USD ). Bitcoin Dominance 5/21/25 (CoinGlass) Bitcoin's dominance of the $2.06 trillion digital asset market is 61.5% per CoinGlass data. While this is obviously a large share of the crypto market, BITW and GDLC are both closer to 80% BTC. To be sure, the overwhelming majority of the assets in the cryptocurrency market are entirely uninvestable. Thus, over-weight BTC makes sense. But there are assets held within BITW that I do think could be long-term successes and even potentially outperform BTC over the next 10 to 20 years. In that regard, choosing BITW over something like a self-directed crypto-IRA might not make sense for long-term investors who have a willingness to open such an account - and there are several providers. Another potential issue with BITW is the opportunity cost of holding stake-able assets dormant in a fund that isn't generating yield. Ethereum ( ETH-USD ) and Solana ( SOL-USD ) collectively make up nearly 15% of BITW positioning. Each of those assets are stake-able for yield and provide investors a positive real yield after token emissions inflation. It is anticipated that staking could soon be permitted in US-based crypto ETFs under the current administration. If such products enter the market, BITW could theoretically trade at a deeper discount to NAV. Top Holdings Valuation Assessment The fund always has 10 assets under management, though those assets with smaller allocations do often change. As of May 20th, BITW asset weightings are as follows: BITW Holdings 5/20/25 (Bitwise) I've already mentioned the large weighting to BTC. From there, ETH commands 11%, XRP ( XRP-USD ) claims 5%, and SOL comes in at 3.2%. With less than 2% combined allocation to the bottom five assets in the fund, I'm not going to spend much time on those networks. However, the top 4 coins in the fund do have a meaningful allocation and represent more than 97% of BITW. We'll take a look at network valuation metrics for those funds and examine what, if any, alternatives there may be for investors who want larger exposure to those assets than what is currently provided by Bitwise. We already know BITW trades at a discount to the fund's liquidation value. But what about the assets themselves? Can we justify such coin prices based on fundamental usage? I've covered Bitcoin's valuation in prior SA pieces. My personal view is that the NVT ratio is a decent way to assess BTC valuation because it utilizes the coin's market cap as well as the dollar-denominated value transferred over the network. BTC Price vs 30 Day Average NVT ( Coin Metrics ) The multi-year trend in BTC's 30-Day average NVT ratio is admittedly not a great one. What this shows is that over the longer term, as BTC's price moves higher, the NVT ratio generally does as well. That said, at 186 currently, the NVT ratio is well-off highs from last summer. I would personally like to see this ratio come down even further. But what I find to be a positive sign currently is the price rise in BTC near the end of last year was accompanied by a deep drop in NVT ratio. This would indicate that the coin price wasn't outgrowing the transferred value. In my view, NVT is good for networks that intend to be 'payment chains.' Because of this, we could choose to view XRP through this lens as well: BTC vs XRP NVT Ratio ( Coin Metrics ) Believe it or not, XRP was actually cheaper than BTC based purely on NVT ratio for most of the last two and half years. While the 220 ratio reading for XRP currently is back ahead of BTC, the long-term trend for XRP's NVT valuation has been quite opposite that of BTC. I'm not arguing either of these coins are 'cheap' based on this metric - quite the opposite, actually. But I think these can be helpful in showing long-term price vs usage trends. For the smart contract chains, fees are a meaningful part of the underlying economics of the networks. There, I like to look at price to fees ratios of the chains: Weekly Circulating P/F Ratios (Token Terminal) Token Terminal's data shows Ethereum is trading at over 760x fees. Based on this metric, Ethereum is now valued more richly than NEAR Protocol ( NEAR-USD ). Solana, which has been cheaper than Ethereum on a circulating P/F multiple since October, is also seeing the ratio generally moving in the wrong direction. At 136x fees currently, Solana has seen significant multiple expansion since February. What Alternatives to BITW Are There? I've already mentioned that investors who have a willingness to open self-direct crypto IRAs can certainly do that. In those types of accounts, there are typically no storage fees, but transaction fees can be high for those who are active traders. There are usually dozens of trade-able digital assets, and it would be quite easy to overweight most of the top 'altcoins' in the market if one were so inclined. However, not everyone wants to open an additional account due to either the inconvenience or the potential personal data security concern - each of which are justifiable in my view. Can BITW's current digital asset exposure be mimicked by purchases of single-asset products that are already available in the market? Possibly. Asset Spot ETF? Closed-End Fund? Leveraged Fund? Bitcoin Yes Yes Yes Ethereum Yes No Yes XRP No No Yes Solana No Yes No Cardano ( ADA-USD ) No No No Sui ( SUI-USD ) No No No ChainLink ( LINK-USD ) No Yes No Avalanche ( AVAX-USD ) No No No Litecoin ( LTC-USD ) No Yes No Polkadot ( DOT-USD ) No Yes No Source: Author's compiled data, funds must be secondary market trade-able not only available through private placement As far as I can tell, only three of the assets in BITW are lacking direct exposure through some combination of spot ETFs, closed-end funds, or leveraged funds. Collectively, those three assets make up less than 2% of BITW. So it is theoretically possible to self-direct exposure to the majority of the assets in BITU through a standard brokerage account utilizing the single-asset products that are already available in the market. Closing Thoughts For those who want a simple way to get exposure to some of the top assets in the cryptocurrency market, BITW will work perfectly fine. Potential investors should keep in mind that there are downsides to getting exposure in this way. In my view, the expense ratio is too high, 78% exposure to BTC defeats the purpose of a 'diversified' fund, and there is an opportunity cost to holding stake-able assets in a fund that doesn't stake them for yield. That said, at a 14% discount to NAV, BITW is somewhat interesting as a potential arbitrage trade should be more of these assets get spot ETFs in the US. While I don't personally hold this fund at this time, it's one of which I've held in the past and would consider holding again if the discount gets to parity with the non-BTC asset allocation of the fund. That said, the discount arbitrage can close simultaneously to a drop in share price. That's a major risk to consider. I would argue that none of the assets in BITW could realistically be considered 'cheap' based on network usage levels.