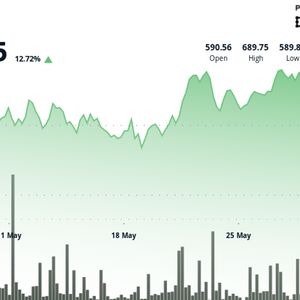

Bitcoin’s record-breaking rally to an all-time high of $112,000 on May 22nd has ushered in a wave of heightened investor expectations. The surge, catalyzed by a sudden bullish breakout following the White House’s decision to delay 50% tariffs on EU goods, has since been tempered by geopolitical uncertainty and clear signs of market overexuberance. Social Chatter on Bitcoin Santiment’s data shows a sharp uptick in crowd optimism precisely as Bitcoin peaked, which led to an immediate correction. This is a reminder that extreme greed often precedes market pullbacks. Positive sentiment across platforms like X, Reddit, and Telegram hit its highest point this year on May 22, only to be swiftly reversed when President Trump’s tariff threat caused market jitters. Although the federal court ruling on May 28 deemed the “Liberation Day” tariffs unconstitutional, offering temporary relief, Santiment warned that recurring tariff-related discussions are now a key driver of volatility. Mentions of “tariff” and “trade war” spiked on social media in the final days of May, mirroring patterns observed during the April correction. Despite the cooling, the crowd remains bullish. The most popular Bitcoin options call is now for $300K. This sentiment depicted rising long-term expectations despite near-term instability. Santiment’s report also explained the reliability of crowd sentiment as a counter-indicator, with extreme fear on May 25 coinciding with Bitcoin’s rebound to $106K. Meanwhile, blockchain fundamentals continue to show strength. Over 147,000 BTC have exited exchanges in 2025, which reduced immediate sell pressure and suggested continued confidence among holders. The Mean Dollar Invested Age (MDIA) has declined steadily since mid-April, indicating that older coins are being reactivated. Such a trend is typically a bullish signal associated with ongoing price expansions. Santiment noted that these shifts suggest the rally is driven not solely by speculative frenzy. BTC’s Path Ahead BTC whales continue to shape market tops. On the day of Bitcoin’s ATH, there were 18,782 transactions of over $100,000. Interestingly, this was the highest since Trump’s inauguration in January, suggesting significant profit-taking by institutional players. In fact, one whale held a 40x leveraged position now worth $1.2 billion. As such, the report warns that a liquidation event below $104,810 could trigger a cascade of long positions unwinding. As Bitcoin enters a new phase of price discovery, data shows that emotional extremes and external shocks continue to dictate short-term moves, even as exchange flows and coin age metrics point toward deeper bullish foundations. The road to $300K may be steep, but investor expectations, like Bitcoin’s price, have never been higher. The post Bitcoin’s Path to $300K Could Face Geopolitical Risks, While Emotional Trading Add Uncertainty appeared first on CryptoPotato .