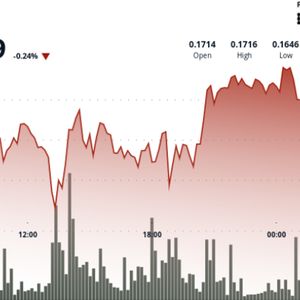

While Bitcoin (BTC) experienced a major rally last week, rising to $109,000, the tension between Israel and Iran overshadowed this. As selling pressure increases in Bitcoin, sellers are trying to take control. At this point, Bitfinex analysts said in a recent report that selling pressure from the Israel-Iran tensions has increased and Bitcoin is at risk of falling further. Despite the risk of a drop, analysts added that Bitcoin needs to hold above $102,000 for a potential recovery. At this point, analysts said that Bitcoin’s current situation resembles previous patterns that usually result in Bitcoin rallying shortly after aggressive sell-offs. “These sell-offs resemble past capitulations and often signal local bottoms. “If Bitcoin can hold the $102,000-$104,000 zone, it means that the selling pressure has been absorbed and the market is ready to recover.” Analysts also added that technical indicators suggest a short-term bottom between $102,000 and $104,000. That could potentially trigger a rally above $112,000, or new all-time highs, within six to eight weeks. Similar patterns have eventually led to rallies of 18-25% in Bitcoin, according to analysts. This Level Indicates a Bull-Bear Line in Bitcoin! Apart from Bitfinex analysts, analysis company Alphractal also pointed to $98,000 for Bitcoin. Alphractal noted that Bitcoin is likely to remain bullish as long as it remains above the key $98,300 support. However, breaking this threshold could tip BTC into a deeper correction. “As long as Bitcoin remains above the Realized Price of short-term investors (STH), we can still consider the market bullish. The bullish scenario only changes if BTC loses the $98k level, which could trigger a deeper decline.” *This is not investment advice. Continue Reading: Which Levels Should Be Followed Next in Bitcoin? Analysis Company Announced, "The Continuation of the Bull in Bitcoin Depends on This Level!" He Said!