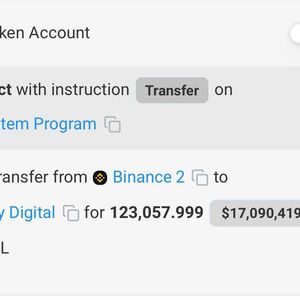

Vandell Aljarrah, co-founder of Black Swan Capitalist and a recognized figure in the digital asset space, recently posted a bold claim about BlackRock. According to Aljarrah, the world’s largest asset manager already owns XRP, XLM, and HBAR. While there has been no official confirmation, he suggested this aligns with BlackRock’s history of moving early on undervalued assets with long-term potential. In his post on X, Aljarrah wrote, “Anyone familiar with their playbook knows they’re always steps ahead,” implying the firm had already secured positions in these assets well before public disclosure. He ended his post by stating, “You’ll hear about it soon.” BlackRock already owns XRP, XLM & HBAR. No official word, but anyone familiar with their playbook knows they’re always steps ahead, locking in the most undervalued assets with serious long-term upside before the crowd catches on. You’ll hear about it soon. — Vandell | Black Swan Capitalist (@vandell33) April 13, 2025 Strategic Implications for Digital Assets If the claim proves accurate, the implications for XRP, XLM, and HBAR could be significant. BlackRock’s involvement would boost the credibility of these tokens and likely draw further interest from traditional financial institutions. Known for its strategic planning and long-term asset accumulation, BlackRock enters positions quietly, often before large price movements. Aljarrah is not the first to make this claim, as Edoardo Farina, another well-respected CEO in the XRP community, recently stated that BlackRock is looking to accumulate tokens from retail users at low prices. Although XLM and HBAR offer enterprise-grade solutions in payments and distributed ledger technology, XRP’s positioning is notably more developed. With its focus on cross-border settlements and existing partnerships with financial entities, XRP stands out as the most institutionally integrated among the three. XRP’s advantages have made it attractive to financial institutions , making Aljarrah’s claim very likely, as BlackRock often moves fast and invests in promising assets and technology early. We are on twitter, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) July 15, 2023 Why XRP Could Benefit the Most Among the tokens mentioned, XRP may be the primary beneficiary if BlackRock holds it. Meanwhile, various financial institutions use the token for real-time payment systems and liquidity management. Recent legal clarity in the U.S. has also made XRP more accessible to institutions. Ripple now has the freedom to sell XRP to institutions , and investing in the asset no longer carries the risk that once made these institutions hesitant. A quiet investment by BlackRock would further affirm its role as a key utility token in the evolving financial system. Institutional Confidence and Long-Term Vision BlackRock’s potential interest in these assets suggests a broader vision. Rather than chasing speculative tokens, the firm focuses on assets with infrastructure-level utility. If confirmed, these holdings would represent a calculated move to secure long-term value rather than short-term gains, and it could potentially increase the adoption and prices of these assets as other institutions follow in BlackRock’s footsteps. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post Rumor: BlackRock Already Owns XRP appeared first on Times Tabloid .