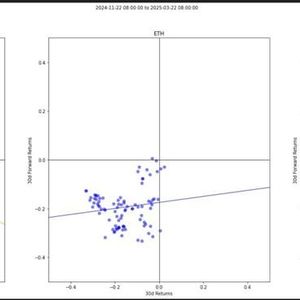

Although market headlines are frequently dominated by moves in Bitcoin , they have seemingly been overtaken lately by Ethereum , which is surging in the background. And yes, these moves seem to be far from a coincidence. Beyond the occasional blockchain hackathon, it inking big partnerships and winning big institutional backers seems to be on a roll with major momentum, and all eyes are on it to see what will happen next. This past week, Ethereum broke multiple on-chain records. The standout was that the number of active addresses on the network hit an all-time high of 15.4 million — a staggering 62.7% increase. This activity has usercount moving toward a top-tier internet project, for instance, in our pro forma, we have 15.4 million active addresses—way ahead of any public Web3 project. Most of this in off-chain activity, of course, and in this case, actual user counts seem to be leading indicators of upcoming price moves. Contributing to the bullish sentiment is the growth of Ethereum’s Layer 2. Layer 2 solutions—like Arbitrum, Optimism, and Base—are scaling Ethereum by processing transactions off the main chain and securely settling back onto it. As of this week, Layer 2 networks now process 6.65 times more transactions than Ethereum’s base layer itself. This shows that not only is Ethereum’s scalability roadmap working, but it’s also thriving. BREAKING: Ethereum is booming behind the scenes. In just one week: • 15.4M active addresses (ATH, +62.7%) • Layer 2 dominance hits 6.65x • BlackRock keeps buying ETH Scalability is working. Adoption is rising. Ignore the FUD — Ethereum is quietly getting stronger. #Ethereum … pic.twitter.com/5bVryCmRfo — Crypto Patel (@CryptoPatel) April 30, 2025 Institutional Confidence Mounts as BlackRock Doubles Down Undoubtedly, one of the most revealing indicators of Ethereum’s bolstering trajectory is the escalating assurance from the titans of industry. BlackRock, the largest asset manager on the planet, has not only been accumulating ETH in recent weeks but also has taken a couple of gigantic strides toward the tokenization of real-world assets on the Ethereum blockchain. In a significant new development, BlackRock has undertaken the momentous step of submitting to the authorities its plan to turn into digital tokens the shares of its $150 billion Treasury Trust Fund, and to do so using the Ethereum blockchain. That path paved by BlackRock—to digitize U.S. Treasury loans and make them Ethereum blockchain native—seems likely to end in a very big place indeed, since Treasuries are pretty clearly the high-water mark for digital assets. This action isn’t merely symbolic: it signals the budding onset of a huge tectonic shift, whereby traditional assets become programmable and composable through smart contracts. For Ethereum, it’s nothing short of a monumental coming-out party. After all, what could validate its vision as a Layer 1 settlement system for the future of programmable finance better than the meta-move of making traditional finance assets usable on its network? The latest expression of this momentum is that Spot Ethereum ETFs chalked up a net inflow of $18.4 million on April 29. That marks the fourth day in a row for these ETFs to record positive inflows. While the numbers for Ethereum are not close to what Bitcoin ETFs are doing, they are still impressive when taking into account the uncertainty that has engulfed Ethereum’s regulatory situation in the U.S. lately. Investors are not letting any of that affect their judgment, it seems. On April 29, spot Bitcoin ETFs recorded a total net inflow of $173 million, marking eight consecutive days of net inflows. Spot Ethereum ETFs saw a net inflow of $18.40 million, continuing a four-day streak of net inflows. https://t.co/SF4brkl9iI — Wu Blockchain (@WuBlockchain) April 30, 2025 Yet it’s not only bullish buy-side flows driving this activity. Whales—large holders of ETH—seem to be taking some profits off the table. Over the last few days, these whales sold about 262,000 ETH, worth around $445 million. This is obviously quite a lot of Even with some occasional fear, uncertainty, and doubt (FUD) in the market, Ethereum is growing stronger behind the scenes. Its scaling infrastructure is on the up and up, user adoption is at an all-time high, and now even institutional players are building on the network. Whales took advantage of the recent price surge, selling 262,000 #Ethereum $ETH , worth around $445 million. pic.twitter.com/sQ0PhAzyfX — Ali (@ali_charts) April 29, 2025 These developments are converging—record network activity, a burgeoning Layer 2 ecosystem, ETF capital inflows, and the real-world asset tokenization trend—around Ethereum and are quietly remaking it into something very different from the public good as originally advertised. In an area often pushed by speculation and hype, recent strides by Ethereum serve as a reminder that real fundamentals still count for something. The clever money in this market is noticing — and doing quite the opposite of panicking. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !