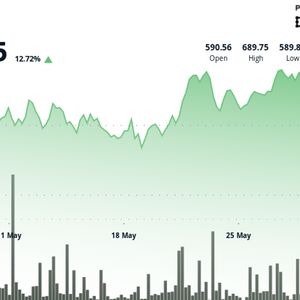

Ethereum has seen a significant surge , sparking curiosity about which altcoin might be next. As investors eye potential gains, the spotlight turns to XRP and ADA . Could either of these coins follow Ethereum's lead and drive the next big movement in the market? This article explores which of these cryptocurrencies may be poised for a breakout. Ethereum Price Dynamics: Short-Term Rally Amid Long-Term Corrections Ethereum experienced a notable price jump over the last month, rising by nearly 52% with a steady weekly increase. However, over the past six months, the coin saw a downturn of almost 24%, highlighting a period of significant volatility. Recent data indicates a rapid recovery in the short term, while the longer-term trends suggest a cautious approach due to previous declines. Current trading levels are confined between approximately $1469 and $2038, with resistance at around $2281 and a secondary level near $2850. Support is noted at roughly $1142, with additional support near $573. Bull strength is present with momentum indicators and an RSI at 71.50, yet the absence of a clear trend suggests traders should exercise caution when navigating these key levels. XRP Price Dynamics: Recent Moves and Key Levels Over the past month, XRP showed limited movement, with a slight decrease of 0.41%. In contrast, the six-month performance has been more positive, reflecting a gain of nearly 27%. The price action remains cautious, indicating a potential upward trend amid short-term fluctuations. The recent stability points to a consolidation phase, supported by consistent trading volume and momentum indicators that show mixed strength. Currently, XRP is trading between $1.75 and $2.50, with resistance at $2.80 and $3.55, and support at $1.31 and $0.56. Market indicators reveal modest bearish pressure, although a clear trend has not yet formed. Trading strategies may involve buying near support levels and selling at resistance zones while remaining aware of possible changes in market sentiment. Cardano Market Snapshot: Trends and Key Support Levels Cardano showed a modest gain in the last month, rising by 6.67%, though it dipped 2.34% in the past week. Over the last six months, its value decreased by 30.05%, indicating a challenging environment for longer-term holders. Price movement fluctuated between $0.55 and $0.78, demonstrating a mixed performance amid varying market sentiments. Current trading sees Cardano hovering near resistance at $0.88 and support at $0.41, with an additional resistance at $1.11 and support at $0.18. Oscillator readings are low, and the RSI is at 50.87, reflecting a balance between bulls and bears. This suggests a consolidation phase, presenting opportunities for carefully targeted trading between these key levels. Conclusion Ethereum 's price surge has set the stage for other altcoins. XRP shows promise due to its strong financial sector ties. ADA is gaining attention with its focus on innovation and technology. Both have the potential to follow ETH's upward trend soon. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.