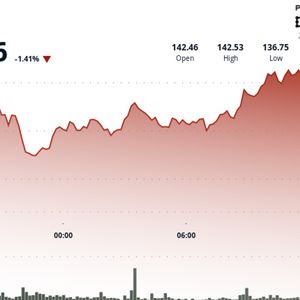

China’s housing market is collapsing and there’s no one left to rescue it. Developers are stuck, buyers are missing, and the population is falling off a cliff. The country’s real estate mess didn’t start this year. It’s been spiraling since late 2020, and now the final nail is demographic: fewer people are alive to buy homes. That means more empty apartments, fewer home sales, and a property sector bleeding out with no real solution. The numbers are brutal. Goldman Sachs said this week that China’s new home demand in urban areas is stuck at under 5 million units per year, down from 20 million in 2017. The problem is simple. There are fewer people being born, more people dying, and no growth left in the cities. “Falling population and slowing urbanization suggest decreasing demographic demand for housing,” the bank’s economists wrote in their Monday note, as reported by CNBC. Fewer babies, fewer buyers, fewer homes sold The World Bank now expects China’s population to shrink below 1.39 billion by 2035, compared to 1.41 billion today. Tianchen Xu, senior economist at the Economist Intelligence Unit, said the drop is because of fewer births and more deaths tied to an aging population. Goldman Sachs added that this will knock down home demand by half a million units every year this decade, and that hit gets steeper in the 2030s—1.4 million fewer homes sold each year. In the 2010s, population growth added 1.5 million units to demand every year. That’s completely flipped now. The country tried to fix it. In 2016, Beijing ended the one-child policy. They also pushed cash incentives to get people to have more kids. None of it worked. Fertility rates kept falling. Xu said these policies have “limited effect” because they don’t fix real-life problems like poor income, unstable jobs, and the high cost of having children. He also said many younger people are delaying marriage, choosing careers instead, or just not interested in starting families at all. And the collapse is visible in schools. Over the past two years, nearly 36,000 kindergartens shut down across China , based on data from the Ministry of Education. More than 10 million preschool students vanished from the system. The number of elementary schools dropped by almost 13,000 between 2022 and 2024, which is erasing the education-based housing demand that once drove prices up in key neighborhoods. People used to pay premiums to live near top schools. Now those premiums are evaporating. William Wu, property analyst at Daiwa Capital Markets, said fewer kids and changing enrollment rules mean those homes don’t hold the same value. Local governments are also scaling back district-based school access, which used to drive up prices. One mother in Beijing reportedly told CNBC she bought her apartment two years ago for double the average price in the city. She did it so her 7-year-old son could get into a good public school. But now the unit is worth 20% less. That timeline matches up with Wind Information’s data showing that first-grade enrollment in 2023 was the highest in two decades—right before it crashed again in 2024, the year her son started school. Prices fall harder as no one buys The property market hasn’t recovered from the crash that started in late 2020. Government action—both national and local—has done little to slow it down. Since last September, a series of measures rolled out, but they barely made a dent. New home prices dropped in May at the fastest pace in seven months, Macquarie’s chief China economist Larry Hu said. It’s been two straight years of price decline. Sales are falling just as fast. In the first half of this month, new home sales across 30 major China cities dropped 11% year-on-year. That’s worse than the 3% drop in May. Hu added that even though the government is trying to support the market , none of it is stopping the bleeding. Goldman expects the rise in urban living to slow in the next few years. That kills off what’s left of the growth story. Wu agreed. He said the real impact of China’s demographic crash on property won’t hit all at once. It’ll take decades. Still, he pointed out that “some of this decline will be offset by continued urbanization, and housing upgrade demand.” But right now, those upgrades aren’t coming in fast enough. Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More