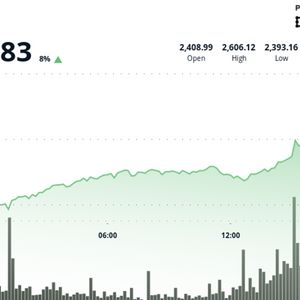

Jerome Powell confirmed the Federal Reserve cannot hold Bitcoin, leaving the decision to Congress. Though some lawmakers and President elect Trump support a U.S. Bitcoin reserve. Powell’s comments caused Bitcoin to drop 5.7%, with other major cryptos also losing value, and the stock market reacted negatively. Powell Says No to U.S. Bitcoin Reserve Jerome Powell Fed Chair has made a point during a press conference that the U.S. central bank is not allowed to hold Bitcoin. He explained that according to the Federal Reserve Act, there are rules about what the bank can own, and Bitcoin is not part of that. He also stated that the Federal Reserve is looking for something other than a law change by leaving the decision to Congress. “We’re not allowed to own bitcoin. The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s something for Congress to decide, not the Fed.” These statements came after questions about the possibility of the U.S. government building a Bitcoin reserve, similar to how it holds gold. Powell stressed that any decision on the U.S. government holding Bitcoin would be up to Congress and not the Federal Reserve. He clarified that the central bank is interested in something other than getting involved in Bitcoin or changing its laws. Despite Powell’s firm stance, there has been growing interest in Bitcoin as a potential asset for the U.S. government to hold. Trump has supported the idea, suggesting that the U.S. should not fall behind other countries in the global crypto race. Some pro- crypto senators including Senator Cynthia Lummis from Wyoming, have been pushing for this idea. Lummis has even drafted a bill requiring the U.S. Treasury to buy one million Bitcoin over the next five years. President-elect Donald Trump has also supported the idea of the U.S. creating a Bitcoin reserve, saying the U.S. needs to stay ahead of countries like China by embracing digital currencies. Market Reaction to Powell’s comments After Powell’s comments, the cryptocurrency market reacted quickly. Bitcoin dropped to $100,300 which is down about 5.7% over the past 24 hours. By the time of the press release, Bitcoin was trading at $100,740. The cryptocurrency market also fell. Ethereum fell by 6.8%, Binance Coin (BNB) dropped by 4.6%, and Solana (SOL) by 8.1%. Dogecoin (DOGE) performed the least among the top 10 positioned tokens which is dropping by 11% to $0.348. The stock market also equally reacted negatively to Powell’s comments. The S&P 500 closed with a loss of 1.55%, and the Nasdaq 100 dropped by around 2%. These show how market is reacting to the news about government policies, especially when it comes to cryptocurrencies like Bitcoin. Powell’s stance on not supporting a Bitcoin reserve created uncertainty among investors and also, they quickly adjusted their positions by selling. Jerome Powell’s comments made it clear that the Federal Reserve is not interested in holding Bitcoin or supporting the U.S. Bitcoin reserve. The market’s reaction showed how Bitcoin and other cryptocurrencies are dependent from investors and policymakers. Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap