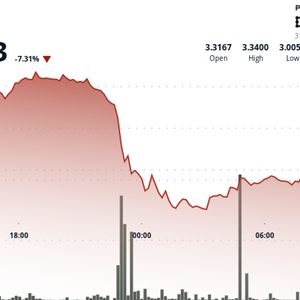

Digital asset investment products saw modest inflows of $48 million last week. While nearly $1 billion flowed in during the early part of the week, outflows of $940 million in the latter half reversed much of the gains. This shift followed the release of new macroeconomic data and the Federal Reserve’s minutes, which signaled a stronger US economy and a more hawkish stance. According to CoinShares, this could indicate that the post-US election honeymoon has ended, with macroeconomic indicators regaining their influence on asset prices. Modest Inflows Amid Renewed Macroeconomic Concerns The latest edition of ‘Digital Asset Fund Flows Weekly Report’ revealed that Bitcoin attracted $214 million in inflows last week, maintaining its lead as the best-performing digital asset with $799 million in inflows year-to-date, despite also seeing the largest outflows later in the week. Inflows to short Bitcoin products stood at $1.8 million. Ethereum, on the other hand, struggled the most, with $256 million flowing out, which CoinShares attributes to a general tech sector downturn rather than asset-specific concerns. Solana, by contrast, remained strong, pulling in $15 million in new investments. XRP amassed significant inflows of $41 million last week, driven largely by political and legal developments. The inflows reflect growing optimism as the January 15th SEC appeal deadline approaches. Multi-asset products followed suit with $21.1 million in inflows. Interestingly, altcoins attracted investments despite lackluster price performance. Leading the way were Aave, Stellar, and Polkadot, which recorded inflows of $2.9 million, $2.7 million, and $1.6 million, respectively. Additionally, Cardano, Litecoin, and Chainlink also saw inflows of $1.2 million, $0.7 million, and $0.4 million, respectively, during the same period. Switzerland Tops Outflows In terms of geography, the US stood out with $79 million in inflows, followed by Germany with $52.4 million over the past week. Canada, Brazil, and Australia also observed inflows of $37.1 million, $21.9 million, and $10.3 million, respectively. Switzerland saw the highest outflow for the week, recording $85.3 million. A similar sentiment was seen across Hong Kong and Sweden as the two countries witnessed outflows of $36.6 million and $33.2 million, respectively. The post Post-US Election Honeymoon Ends as Macroeconomic Data Drives Markets appeared first on CryptoPotato .