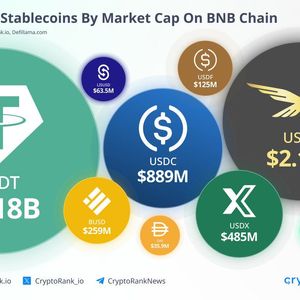

The XRP price has suffered a harsh reversal this month, moving into a bear market after falling by almost 30% from its highest level in January. Ripple ( XRP ) token crashed to a low of $2.4335 on Wednesday as its daily trading volume and futures open interest tumbled. CoinGlass data shows that futures open interest dropped to $3.45 billion on Wednesday, down from $7.45 billion in January. This is a sign that investor demand has dropped in the past few weeks. The daily XRP volume has dropped to $4 billion from over $32 billion a week ago. Several catalysts may push the XRP price higher in the coming months. Polymarket’s odds of a spot Ripple ETF have jumped to over 80%. According to JPMorgan, spot XRP ETFs may experience over $8 billion in inflows in the first year. This would be notable since spot Ethereum ETFs have accumulated just $3 billion in inflows. Ripple Labs has continued to ink deals that will help it become a leading player in the financial services industry. For example, it has partnered with Unicambio, a Portuguese currency exchange provider that will use its network for currency transactions. Planting the Ripple flag in Portugal today with Unicâmbio, our first Portuguese client and the country’s leading currency exchange provider! Using Ripple Payments, their corporate customers can now move funds near instantly between 🇵🇹 & 🇧🇷. https://t.co/ruOdZnHtAT — Ripple (@Ripple) February 10, 2025 Ripple also received a money transmitter license in New York and Texas, allowing it to operate its services in these two major US states. Further, Ripple USD has continued to gain market share, with its daily volume hitting over $200 million, higher than most other stablecoins . You might also like: Ripple price at risk as meme coins crash, XRP Ledger growth stalls XRP price may be at risk of a deep dive XRP price chart | Source: crypto.news The Wyckoff Theory, which is about 95 years old today, explains how financial assets move over time. It identifies four phases: accumulation, markup, distribution, and markdown. XRP price remained in an accumulation phase between 2022 and November 2024. This phase is characterized by consolidation, and in XRP’s case, it remained between $0.3260 and $0.9326. It then moved into the markup phase in November as its price surged, leading to Fear of Missing Out among investors. This phase has higher demand than supply. XRP has now moved into the distribution phase, which is characterized by high volatility. If the theory works out well, it will now move into the markdown phase, which may see it drop to the support at $0.9325. This support coincides with the 78.6% retracement point and is 61% below the current level. The bearish view will become invalid if the Ripple price rises above the year-to-date high of $3.40. You might also like: CZ says we need more dApps after new chains crash