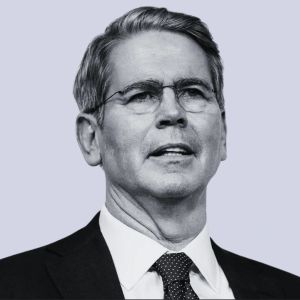

The White House is in full crisis mode, as Treasury Secretary Scott Bessent said Sunday that the U.S. was on the brink of a financial collapse thanks to reckless government spending over the past few years. Now, the administration is scrambling to fix it. “What I could guarantee is we would have had a financial crisis. I’ve studied it, I’ve taught it, and if we had kept up at these spending levels that—everything was unsustainable,” Bessent said on NBC’s Meet the Press . “We are resetting, and we are putting things on a sustainable path.” Trump slashes government spending President Donald Trump has made cutting costs a top priority. He launched the Department of Government Efficiency, led by Elon Musk, to trim the fat across multiple federal agencies. The goal? Fewer jobs, more early retirements, and lower government spending. But despite these efforts, the numbers tell a different story. The U.S. budget deficit for February alone passed $1 trillion, worsening the debt situation. Even Bessent isn’t promising a smooth recovery. “There are no guarantees” the country won’t hit a recession, he admitted. Wall Street isn’t taking this lightly. Markets have been on edge as Trump’s aggressive tariff policies spark fears of inflation and economic slowdown. The S&P 500 tumbled into a 10% correction from its February high, sending volatility through the roof. Bessent doesn’t seem concerned. “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal,” he said . “What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis. It would have been much healthier if someone had put the brakes on in ’06, ’07. We wouldn’t have had the problems in ’08.” Bessent backs Trump’s economic agenda Scott Bessent didn’t just step into the Treasury to keep things quiet. He’s become one of the loudest voices pushing Trump’s MAGA 2.0 economic policies. His stance? Short-term market pain is worth it for long-term economic control. Bessent, a former hedge fund manager, isn’t following Wall Street’s playbook. He’s embracing Trump’s protectionist trade policies and calling for the U.S. to “detox” from government spending. He raised eyebrows recently when he said, “Access to cheap goods is not the essence of the American Dream.” He also dismissed fears over tariffs, saying he was “less concerned” about short-term impacts. “He definitely has not played the role to date that the markets had expected,” said Sarah Bianchi, senior managing director at Evercore ISI. The concern is that there’s no one left in the administration willing to push back on Trump’s aggressive economic moves. Under Trump’s first term, officials like former Treasury Secretary Steven Mnuchin and other economic advisors acted as guardrails, preventing extreme policies from wreaking havoc. Those restraints are now gone. “Whatever the guard rails that were in place the first administration no longer exist,” said a former Trump official. Bessent’s close ties to George Soros and lack of Republican political experience had many on Wall Street expecting him to take a more traditional, free-market approach. Instead, he’s aligned himself fully with Trump’s America-first strategy, especially when it comes to trade. “Scott is very well aware that there’s some serious economic costs to raising tariffs dramatically,” said Jens Nordvig, founder of Exante Data. But that doesn’t mean he’s resisting them. Unlike Mnuchin, who fought against Trump’s more radical protectionist ideas, Bessent appears to be going along with it. Market fears grow as recession risks loom Trump’s second-term economic agenda is making waves, especially in global trade. Early decisions have hit China, Canada, and Mexico, causing a ripple effect in the markets. Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer are leading the charge on new trade battles, leaving Bessent navigating some tricky internal politics. The Treasury Secretary and Lutnick aren’t exactly best friends. They both wanted the Treasury job, and tensions between them are well known. “He’s got to be careful so that he’s not a negative Nancy,” said a person familiar with the situation, comparing their relationship to a “Brazilian knife fight with the lights out.” Despite concerns, the White House insists Bessent is fully behind Trump’s vision. A Treasury spokesperson put out a statement saying he’s “working tirelessly to enact this mandate on behalf of the President, and ensure that Main Street and Wall Street both reap the benefits of President Trump’s winning economic agenda.” But Bessent himself knows the transition won’t be painless. He recently acknowledged that moving away from public spending to private spending will take time. “There’s going to be a natural adjustment,” he said. “The bottom 50 percent of working Americans have gotten killed. We are trying to address that,” he told CNBC. When asked if the economy inherited by Trump is starting to weaken, he didn’t deny it. “Could we be seeing that this economy that we inherited is starting to roll a bit? Sure.” Wall Street is still waiting for reassurances, but Bessent’s message has stayed the same: long-term economic strength requires short-term pain. “It’s very clear to people now that this is not someone who is simply channeling the voice of markets. This is someone who has a very different view of the world,” said Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center. The shift in Trump’s economic strategy has some economists worried about stagflation or an outright recession. CEOs polled by the Business Roundtable have already scaled back plans for hiring and investment. Goldman Sachs CEO David Solomon recently said policy uncertainty is slowing dealmaking and keeping investors hesitant. Bessent, on the other hand, sees some silver linings. He pointed to a recent drop in long-term borrowing costs and lower gas prices as proof that the administration’s strategy is working. But at the same time, he admitted the U.S. is undergoing a fundamental shift, and that’s going to hurt before it helps. “There is no doubt that Trump has had a big impact on his thinking on the economy,” said Stephen Moore, a former Trump advisor. Moore noted that Bessent has managed to avoid stepping on Trump’s toes in media appearances, a skill that many of Trump’s former economic officials failed to master. On policy, Moore said Bessent has “become more Trumpian in how he thinks about how these policies impact blue-collar, middle-class America.” Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot