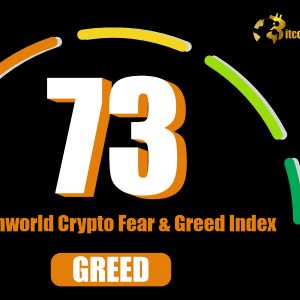

Cryptocurrency markets face more than $486 million worth of digital assets scheduled for release between March 17-24, 2025. Based on information by Tokenomist, those unlocks can be characterized as either “cliff” releases – a major concentrated drop at one time – or linear drops across various projects. In terms of upcoming cliff unlocks, Fasttoken (FTN) is featured at the front of the line with 20 million tokens at a value of around $79.8 million worth of FTN, or 4.65% of the circulating supply. Crypto unlock schedule After the $79.8 million release of Fasttoken, QAI with 565.69 million tokens worth $41.64 million, will see the second-largest cliff unlock. OM comes in third with 5 million tokens that are worth $34.3 million. Other notable cliff unlocks include ZKJ releasing tokens valued at $31.83 million (25.72% of circulating supply), ID with $19.15 million (18.23% of supply), and the MELANIA token with a $19.54 million unlock. Immutable X (IMX), ApeCoin (APE), and MURA complete the major one-time releases with unlocks valued at $13.59 million, $8.15 million, and $7.1 million respectively. Source: Wu Blockchain On the linear unlock side, Solana takes the lead with 465,770 tokens worth $59.79 million. This is only 0.09% of its circulating supply, though. Worldcoin (WLD) comes in second with $31.82 million worth of tokens (3.19% of supply), followed by TIA, which will release $23.8 million worth (1.3% of supply). Well-known meme coin Dogecoin (DOGE) will release 96.52 million tokens worth $16.6 million. Other large linear releases are OM with another $18.18 million on top of its cliff release, TAO with $12.34 million, Avalanche (AVAX) with $13.08 million, and Sui (SUI) with $8.56 million. The rest of the linear releases are JTO, NEAR, DOT, IP, and FIL, with ranges from $7.48 million to $12.76 million. Market liquidity after unlocks The aggregate influence of $486 million in tokens coming to market in one week gives rise to questions regarding how liquidity in trading could take this number of potential supplies. Although the aggregate number seems large, the effect differs for each individual token depending on their current market depth and trading levels. For liquid assets such as Solana, whose daily trading volumes consistently surpass $1 billion, the $59.79 million unlock is a modest fraction of average daily activity. Likewise, Dogecoin’s $16.6 million unlock is not likely to induce price pressure considering its well-established market presence. Conversely, ZKJ’s unlock of 15.53 million tokens valued at $31.83 million is 25.72% of its circulating supply. This is a major shift in token economics that may impact current market liquidity. Likewise, ID’s unlock of 18.23% of its circulating supply may challenge the market to absorb more tokens. Token releases occurring in a bullish environment typically experience less negative price effect as fresh buyers are able to absorb more supply. Unlocks in bearish or volatile market conditions, however, tend to create downward pressure. Token release impact on supply ZKJ faces the largest supply change, with tokens worth $31.83 million representing 25.72% of its circulating supply entering the market at once. Similarly, ID will see 18.23% of its circulating supply unlocked, worth $19.15 million. Fasttoken, despite having the largest unlock by dollar value at $79.8 million, will experience a more moderate 4.65% increase in circulating supply. This places it in a middle tier of impact alongside Worldcoin (WLD), which will see a 3.19% supply increase. Established cryptocurrencies will see minimal supply impact despite large dollar values. Avalanche (AVAX) will see a 0.17% supply increase, and Polkadot (DOT) will experience a 0.15% change in circulating supply. Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More