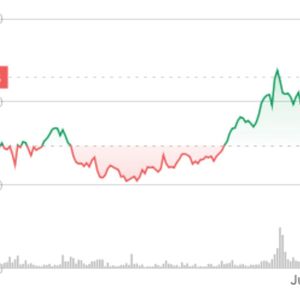

The post Why Crypto Market is Up Today: Key Factors Behind the Surge appeared first on Coinpedia Fintech News The total crypto market cap surged around 2 percent in the past 24 hours to hover about $2.92 on Thursday, March 20, during the early London trading session. The 3.2 percent Bitcoin (BTC) price bump influenced the wider altcoin market led by Ethereum (ETH), XRP, and Solana (SOL), among others. Following the heightened crypto industry volatility, more than $357 million was liquidated from the leveraged market, with the majority invoking short traders. Major Factors Behind Crypto Market Bump Today Gold Price Rally For the first time since the history of gold as a store of value for humanity, the precious metal has closed above $3k per ounce consistently in the past three days. With Bitcoin regarded as digital gold, a rebound from the crucial support level of around $80k was imminent. Meanwhile, the wider altcoin market has depicted a positive correlation with Bitcoin, thus rallying in tandem. U.S. Tariff Inflation On Wednesday, Fed Chair Jerome Powell said that President Donald Trump’s tariff measures have already begun to pump inflation. The Fed expects inflation to rise slightly to 2.7 percent by the end of 2025 from the current level of 2.5 percent. Nonetheless, Jerome highlighted that the economy still looks healthy amid the anticipated slow growth. Following the announcement, U.S. Major stock indexes led by the S&P 500, Nasdaq Composite, and the Dow Jones Industrial Average gained around 1 percent. With the crypto market having depicted a positive correlation with the major stock indexes, the wider crypto industry rallied in tandem. Renewed Demand from Whale Investors The overall demand for crypto assets has gradually increased in the past few days, led by Bitcoin. For instance, the U.S. spot Bitcoin ETFs haste recovered three consecutive days of cash inflows, thus increasing the odds of ending the week in net cash inflows. On Wednesday, Bitwise’s BITB led the rest of the spot BTC ETF issuers in cash inflow after reporting a net cash inflow of about $12 million. Meanwhile, the rising whale‘s on-chain activities resulted in a decline of about 2,022 BTCs from centralized exchanges. Clear Regulatory Outlook As Coinpedia highlighted, the wider crypto market has significantly benefited from the administration change in the United States. Under the Trump administration, several crypto litigations have been dropped by the U.S. SEC and CFTC. On Wednesday, Brad Garlinghouse, CEO of Ripple Labs, announced that the U.S. SEC has dropped the appeal of the long-standing lawsuit against XRP sale.