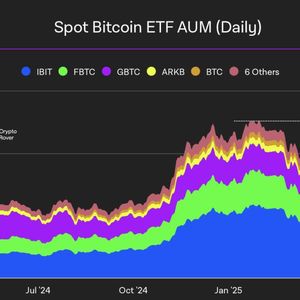

Hold onto your hats, crypto enthusiasts! The wild world of decentralized finance (DeFi) has just delivered another jolt of drama. News has broken about a significant Ethereum sell-off linked to a project with a rather prominent name attached – World Liberty Financial (WLFI), a DeFi venture reportedly associated with the Trump family. Buckle up as we dive into the details of this developing story and what it could mean for the broader crypto landscape. Sudden Ethereum Sell-off Sparks Market Speculation Just moments ago, blockchain analytics firm Lookonchain, armed with data from Arkham, sent ripples through the crypto community with a tweet heard ’round the digital world. They reported a massive Ethereum sell-off originating from a wallet suspected to be linked to World Liberty Financial (WLFI). The numbers are staggering: 5,471 ETH dumped: In a single swift move, the wallet offloaded a hefty 5,471 Ethereum tokens. $8.01 Million Value: This Ethereum sell-off translated to a cool $8.01 million at the time of the transaction. Fire-Sale Price: The ETH was sold at a rate of $1,465 per token. Timing is Everything: This major dump occurred just an hour before the news broke, suggesting a potentially rapid decision. This Ethereum sell-off immediately raises eyebrows and prompts a crucial question: Why now? Was this a strategic move to cut losses, or is there more to this unfolding saga? WLFI’s DeFi Project: A Deep Dive into the Numbers To truly grasp the magnitude of this crypto market loss and the potential implications for WLFI, let’s rewind and examine their initial investment strategy. According to the same reports, WLFI had previously made a significant bet on Ethereum: Massive ETH Purchase: WLFI reportedly acquired a whopping 67,498 ETH. $210 Million Investment: This accumulation cost them a substantial $210 million. High Entry Point: Their average purchase price per ETH was a hefty $3,259. Now, compare this initial investment with the recent Ethereum sell-off price of $1,465. The stark difference reveals a grim reality for WLFI. The Cold Hard Facts: Calculating the Crypto Market Loss Let’s break down the numbers to fully understand the extent of the crypto market loss faced by WLFI: Metric Value Original ETH Purchase 67,498 ETH Total Investment $210 Million Average Purchase Price $3,259 per ETH ETH Sold Recently 5,471 ETH Selling Price $1,465 per ETH Value of ETH Sold $8.01 Million Potential Total Loss (Unrealized) $125 Million As you can see, based on these figures, WLFI is currently sitting on a staggering potential loss of $125 million on their Ethereum holdings. This significant crypto market loss raises serious questions about the future viability of the DeFi project and the investment strategies employed. Trump Family Crypto Link: What’s the Connection to WLFI? The mention of the “Trump family” in connection with WLFI adds another layer of intrigue to this DeFi project saga. While direct involvement remains to be officially confirmed, the reports citing sources linking the project to the Trump family name are circulating widely. This association, whether direct or indirect, inevitably draws increased scrutiny and media attention to WLFI’s operations, especially in the wake of this substantial Ethereum sell-off and subsequent crypto market loss . The potential connection to such a high-profile family amplifies the stakes. Any missteps or financial difficulties within the DeFi project are likely to be magnified in the public eye, potentially impacting not only WLFI but also perceptions of celebrity-endorsed or associated crypto ventures. Analyzing the DeFi Project’s Future: Challenges and Uncertainties The massive Ethereum sell-off and the reported $125 million paper loss paint a concerning picture for the future of the WLFI DeFi project . Several challenges and uncertainties now loom large: Investor Confidence: Such a significant and public crypto market loss can severely erode investor confidence. Will investors continue to back WLFI, or will this trigger further withdrawals and instability? Project Viability: A $125 million loss is a substantial blow to any project. Does WLFI have sufficient reserves to weather this storm and continue its operations? The long-term viability of the DeFi project is now in question. Regulatory Scrutiny: Given the high-profile association and the scale of the reported losses, WLFI may attract increased regulatory attention. The already complex and evolving regulatory landscape for DeFi could pose further hurdles. Market Volatility: The cryptocurrency market is notoriously volatile. While the Ethereum sell-off might be an attempt to mitigate further losses, it could also be a reaction to broader market trends or internal project issues. Actionable Insights: Lessons from the WLFI Ethereum Sell-off This Ethereum sell-off event, regardless of the specific circumstances surrounding WLFI, offers valuable lessons for anyone involved in or considering entering the crypto and DeFi space: Risk Management is Paramount: The WLFI situation underscores the critical importance of robust risk management strategies in crypto investments. Diversification, stop-loss orders, and thorough due diligence are not just suggestions, they are necessities. Due Diligence Beyond the Hype: Celebrity endorsements or high-profile associations should not be the sole basis for investment decisions. Dig deep into the project’s fundamentals, team, technology, and financial health. Understand Market Volatility: Be prepared for significant price swings and market corrections. The crypto market is inherently volatile, and large losses are a real possibility. Transparency and Accountability: Demand transparency from DeFi projects . Understand how they manage funds, mitigate risks, and ensure accountability. Conclusion: A Stark Reminder of Crypto Market Realities The Ethereum sell-off linked to the WLFI DeFi project serves as a stark reminder of the inherent risks and potential pitfalls within the cryptocurrency market. While DeFi offers exciting opportunities, it also demands caution, thorough research, and a realistic understanding of market dynamics. The reported $125 million paper loss for WLFI is a sobering example of how quickly fortunes can change in the crypto world. As the story continues to unfold, the crypto community will be watching closely to see how WLFI navigates these turbulent waters and what lessons can be learned from this high-profile crypto market loss . To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum price action.