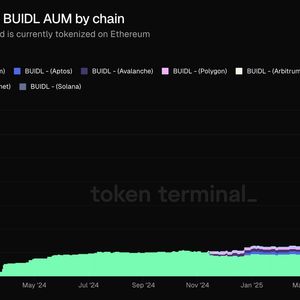

Bitcoin’s downside pressure has seen sell-off dynamics shift from newer coins to older cohorts, with the gradual capitulation coming amid broader market weakness. On-chain metrics and data insights platform Glassnode says Bitcoin ( BTC ) Bitcoin’s downside pressure has seen sell-off dynamics shift from newer coins to older cohorts, with the gradual capitulation coming amid broader market weakness. Year-to-date, BTC has dropped more than 17%, including a 9% decline in the past week. Tariffs and broader economic uncertainty have weighed heavily on risk assets, including Bitcoin . With this performance, coins in the three to six months cohort have seen share of realized losses rise to more than 19%. It only stood at about 0.8% on Feb. 27 before bear market sentiment hit. “In comparison to previous large Bitcoin sell-offs YTD, losses are now spreading to older coins – especially in the 3m–6m group, whose share in loss realization jumped from 0.8% to 19.4% of total losses since Feb 27,” Glassnode posted on X. You might also like: As China hits U.S. goods with 84% tariffs, Bitcoin falls to $76K — will the Fed intervene? A chart the platform shared shows the BTC realized loss by age metric spiking sharply in April. BTC realized loss by age chart by Glassnode Younger coins – in the one week to one month and one month to three months age accounted for more than 50% of total realized losses as February came to a close. However, while the 3m–6m cohort then represented less than 1% of total losses, the trend has since reversed, with this group now accounting for a significantly larger share. This shift intensified as BTC price declined from above $86,000 in late February. A retest of support below $75,000 in March accelerated the move toward capitulation for the 3m–6m holders. By March 11, the 1m–3m group’s share of losses had dropped to about 16.3%, while that of the 3m–6m cohort rose to 4.9%. By Apr 7, losses were evenly split between 1w–1m and 3m–6m, each contributing ~19%. This marks a structural shift in loss realization and points to sustained pressure on mid-term holders. 🔻 $BTC : $78.9k, realized losses: $34.4M 🔹1w–1m: $8.2M (23.8%) 🔹1m–3m: $6.5M (18.9%)… — glassnode (@glassnode) April 9, 2025 Despite total BTC losses falling to roughly $41 million, Glassnode’s on-chain data shows older cohorts are undergoing a “gradual broadening of capitulation.” As of early April, the 1w–1m and 3m–6m cohorts were each responsible for around 19% of realized losses. “This marks a structural shift in loss realization and points to sustained pressure on mid-term holders,” the analysts noted. Bitcoin is down 2% in the past 24 hours. You might also like: Yuan drops to 2007 lows after tariffs, could Bitcoin be the new safe haven?