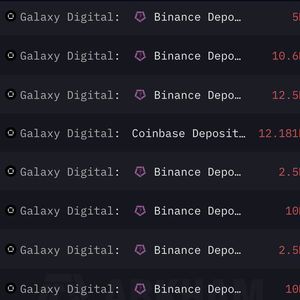

This is a segment from the Lightspeed newsletter. To read full editions, subscribe . When Donald Trump paired his Solana memecoin with USDC, the Solana network’s stablecoin supply predictably shot upwards — creating 306 days of supply growth over a long weekend, as we put it in this newsletter. Although much of this supply growth stemmed from a memecoin that had about 48 hours of relevance, Solana’s stablecoin supply is still near its all-time high. On February 11, Solana had $12.4 billion in stables. Today, it has $12.1 billion. “Definitely it has been stickier than anticipated,” Blockworks Research analyst Carlos Gonzalez Campo said of Solana’s stablecoin supply when I asked him about it on the Lightspeed podcast this week . The stablecoin supply growth means Solana’s liquidity is deeper now, Gonzalez Campo said, noting the stickiness could be partly a result of bear market conditions where users are swapping out of riskier tokens to hold stablecoins on Solana apps instead. He also noted how USDC borrows on Solana money market Kamino are around all-time highs, which he interpreted as meaning investors are leveraging up on long SOL exposure following its recent price slide . Solana is also seeing an accelerating number of new stablecoin brands joining the network. One such example is USDG, a new stablecoin from Paxos with backing from partners including Robinhood, Galaxy Digital and Standard Chartered. The token has a little over $100 million in supply on Solana. There’s also the stablecoin infrastructure platform M^0, which launched on Solana on Tuesday, we reported exclusively. Two new stablecoins from the stablecoin banking outfit Kast are first on the agenda. USDC and USDT work pretty well as non yield-bearing stablecoins, and some have wondered whether new stablecoins are necessary. I made the case a couple times this week that Solana likely does want to change its stablecoin supply makeup from the current 76% USDC. Circle’s S1 filing revealed that 50% of revenue from the Treasurys backing USDC go to Coinbase, which operates a Solana competitor in the Ethereum layer-2, Base. Why wouldn’t Solana try to find a similarly cushy setup? “I think your thought process is right, but you’re skipping a step,” Blockworks Research head of data Dan Smith said in response to this point on our Lightspeed podcast roundup episode . Stablecoin distribution comes from applications, so “I think it skips the chain and goes to the app layer,” Smith said. Get the news in your inbox. Explore Blockworks newsletters: Blockworks Daily : Unpacking crypto and the markets. Empire : Crypto news and analysis to start your day. Forward Guidance : The intersection of crypto, macro and policy. 0xResearch : Alpha directly in your inbox. Lightspeed : All things Solana. The Drop : Apps, games, memes and more. Supply Shock : Bitcoin, bitcoin, bitcoin.