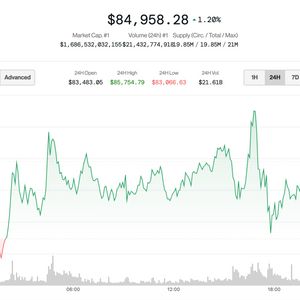

Bitcoin (BTC) drifted ever so gently upwards Monday as the broader market adjusts favorably to trade-related news. The largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7% in the same period of time to $1,630. The broad-market CoinDesk 20 Index — consisted of the top 20 cryptocurrencies by market capitalization except for stablecoins, memecoins and exchange coins — advanced 1.2%, led by gains in SOL and AVAX. After a couple of wild weeks, the stock market also edged higher today, the Nasdaq closing with a 0.6% gain and the S&P 500 rising 0.8%. Strategy (MSTR) and MARA Holdings (MARA), led among crypto stocks with roughly 3% gains. The modest rally came as Federal Reserve Governor Christopher Waller signalling that a return of the original punitive Trump tariffs would trigger the need for sizable "bad news" rate cuts. "[Tariff] effects on output and employment could be longer-lasting and an important factor in determining the appropriate stance of monetary policy," said Waller in a speech . "If the slowdown is significant and even threatens a recession, then I would expect to favor cutting the FOMC's policy rate sooner, and to a greater extent than I had previously thought." Further easing concerns was the European Commission, the executive arm of the EU, confirming to hold off on retaliatory tariffs on U.S. goods worth €21 billion until July 14 to "allow space for negotiations." Odds that the U.S. and EU will reach a trade agreement to avoid tariffs rose to 65% on blockchain-based prediction market Polymarket after U.S. President Donald Trump reportedly stated that a deal was in the works. Bitcoin fundamentals recovering Bitcoin's relief rally from last week's tariff turmoil stalled out around the $85,000 resistance level , but the network's improving fundamentals spur hopes for a breakout, crypto analytics firm SwissBlock Technologies noted. "Since March, we’ve seen a consistent inflow of new participants," Swissblock analysts wrote in a Telegram broadcast. "Liquidity is stabilizing, no more erratic swings from early 2025." "Once the liquidity gauge holds above the 50 line, short-term price action tends to follow with strength," Swissblock analysts said. "With network growth aligning, key levels aren’t just being revisited, they're being accumulated." "This is the kind of structural support that underpins sustainable rallies," they concluded.