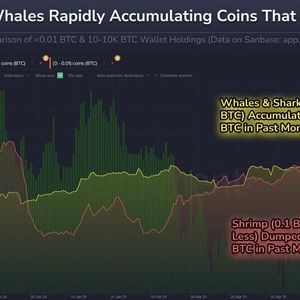

The post Charles Schwab to Launch Spot Crypto Trading by 2026, Boosting Bitcoin and Ethereum Access appeared first on Coinpedia Fintech News Charles Schwab’s new CEO, Rick Wurster, announced that the company is gaining significant momentum in the crypto space and has plans to expand its offerings. During the company’s 2025 Spring Business Update this week , Schwab revealed that it is moving into spot crypto trading, allowing clients to directly buy and sell cryptocurrencies like Bitcoin and Ethereum. This marks a big shift in how major financial firms approach digital assets. Schwab ‘On A Great Path’ to Launch Spot Crypto Trading Schwab currently enables access to crypto through ETFs, closed end funds, and futures. Wuster revealed that they are “on a great path” to launch direct spot crypto trading within the next year. Schwab’s entry into the spot market would be a major step especially as regulatory clarity improves. He called the expansion a response to client demand as well as a strategic move to maintain its role as a top destination for retail and institutional crypto investors. Recently, the CEO highlighted growing interest in Schwab’s crypto offerings like ETFs and Bitcoin futures. Rick Wurster became Schwab’s CEO in 2025 and said in a 2024 interview that the firm was ready to offer crypto trading but was waiting for clearer regulations. Schwab saw a big 40% jump in profits last quarter, as many investors shifted their portfolios due to market volatility. Wurster suggested that some of those investors might be turning to crypto. Notably, there was a 400% surge in traffic to their crypto site, of which 70% was from non-clients which indicates rising public interest. Wurster noted that the massive spike in traffic indicates that investors who were once hesitant to jump into crypto space are now doing so, due to Schwab’s reputation as a trusted financial brand. “As I’ve said numerous times in past, spot crypto trading will be table stakes for every major brokerage,” reacted Nate Geraci, the President of ETF Store, to the development. Schwab CEO expects to launch direct spot crypto trading w/in next 12mos… As I’ve said numerous times in past, spot crypto trading will be table stakes for every major brokerage. via @RIABiz pic.twitter.com/SBtq1bwjcC — Nate Geraci (@NateGeraci) April 19, 2025 Schwab To Join Major Players Spot crypto trading is already offered by major crypto exchanges like Coinbase, Binance, Kraken and Gemini, who lead the space, popular with both retail and institutional users for their deep liquidity, wide range of trading pairs and advanced tools. Besides, Traditional firms are also making moves. Fidelity offers spot Bitcoin and Ethereum trading, while Robinhood and eToro enable commission-free crypto trades alongside stocks and ETFs. Earlier this year, Schwab partnered with Trump Media and Technology Group (TMTG) to launch Truth.fi, a brand offering ETFs, Bitcoin, and other investments. Schwab will manage up to $250 million in assets, focusing on U.S. growth and the “Patriot Economy. Bitcoin Bounces Back Bitcoin surged 0.61% on Saturday, April 19, bouncing back from Friday’s dip reaching $85,033. Notably, it stayed above the $85K mark for the first time in a week. The price boost comes as global trade tensions and economic uncertainty continue, with recent supply-demand shifts pushing BTC higher.