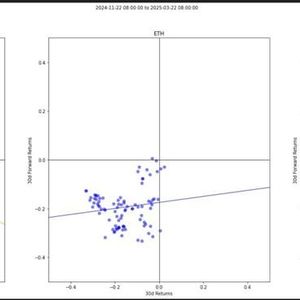

Data shows the Bitcoin Fear & Greed Index is close to the neutral territory again, a sign that market sentiment has seen a cooldown. Bitcoin Fear & Greed Index Is Now Close To Edge Of Greed Territory The “Fear & Greed Index” is an indicator created by Alternative that tells us about the sentiment held by the average trader in the Bitcoin and wider cryptocurrency markets. Related Reading: Old Bitcoin Whales Resurface With $760M Move—Brace For Impact? The index determines the market mentality using the data of five factors: trading volume, market cap dominance, social media sentiment, volatility, and Google Trends. To determine this sentiment, the metric makes use of a numeric scale running from zero to hundred. All values below the 47 mark correspond to a fearful market, while those above 53 imply greed among the investors. The index being between these cutoffs naturally suggests a net neutral mentality. Besides these three main sentiments, there are also two special ones called the extreme fear and extreme greed. The former occurs under 25 and the latter above 75. Now, here is how the Bitcoin Fear & Greed Index currently looks: As is visible above, the Bitcoin Fear & Greed Index has a value of 56 at the moment, which means the investors as a whole share a sentiment of greed. The level of greed is only slight, however, as the metric is just three units above the neutral zone. This wasn’t the case just a week ago, when the indicator hit the 72 mark, signifying the crowd was very close to becoming extremely greedy. The uplift in sentiment earlier was a result of the asset’s recovery rally, but with the price surge stalling recently, it seems the investor optimism has waned. Below is a chart that shows how the indicator’s value has developed recently. The trend in the BTC Fear & Greed Index over the past twelve months | Source: Alternative If Bitcoin’s sideways action continues in the coming days, it’s possible that sentiment would decline into the neutral zone next. This development may not actually be so bad for the cryptocurrency. Historically, BTC and other digital assets have tended to move in a direction that’s opposite to the crowd’s expectations. The probability of such a contrary move occurring usually grows the more sure the investors become of something. This likelihood is naturally the strongest in the extreme zones, so these regions are where tops and bottoms generally occur for the market. Related Reading: Is Bitcoin Demand Returning? Active Address Trend May Suggest So While BTC is in neither extreme territory right now, the fact that investor sentiment has calmed down to nearly the neutral zone may at least make sure that greed wouldn’t become the end of the price rally. It only remains to be seen how things play out for Bitcoin now. BTC Price At the time of writing, Bitcoin is floating around $93,800, down over 1% in the last 24 hours. Featured image from Dall-E, Alternative.me, chart from TradingView.com