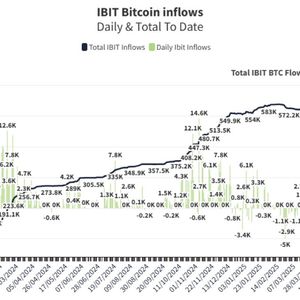

Ethereum price forecasts are bolstered as the altcoin of choice among institutions—BlackRock’s ETF drew $20 million inflows during May 2 trading, while the rest of the cohort saw no movement. The move coincides with what has been a week of volatility, with ETH trading within a narrow range but closing the week at a 3% loss. As the US-China trade war starts to hit consumers and U.S. GDP contracts for the first time since Q1 2022, market momentum has broadly stalled. Yet Ethereum’s traction in traditional investment circles signals growing institutional confidence—strengthening its case in the “best crypto to buy” conversation. Traditional Markets Back Ethereum: What Do They Know? According to CoinGlass data , ETHA attracted $20.1 million on May 2. The addition brings BlackRock’s ETH holding to almost 2% of the total market cap. With ETF inflows in play, BlackRock now holds almost 2% of the $ETH supply. These guys don’t make moves without understanding the bigger picture. pic.twitter.com/an7u6CLCBE — Crypto Rover (@rovercrc) May 6, 2025 This substantial accumulation signals heightened institutional interest and could tighten ETH liquidity on major exchanges, easing volatility through longer-term supply-demand dynamics. The move also comes just ahead of the May 7 Pectra hard fork . The upgrade aims to improve network speed, reduce fees, and improve the quality of life for its users. Pectra also raises the staking cap from 32 ETH to 2,048 ETH, giving institutions a stronger foothold in Ethereum staking. Ethereum Price Analysis: Could This Really Rally to $10K? While a $10,000 Ethereum price is an unrealistic near-term target as economic concerns continue to weigh on risk-on sentiment, there is merit to the argument that ETH could see a surge. The past few months have been turbulent, but they have yet to invalidate a symmetrical triangle pattern forming since 2021. ETH / USDT 1-week chart, symmetrical triangle breakdown. Source: Trading View / Binance. Still, the validity of this pattern hangs in the balance—if the past month’s reversal holds, the dip below the pattern’s lower boundary could be brushed off as a false breakdown. But if momentum fades, Ethereum risks a return to the support zone that has underpinned its 4-month decline at $1400. A breakdown there would open the door to a deeper 40% slide toward $1,050—fully invalidating the pattern. That said, signs of strength are emerging. The MACD line is en route to form a golden cross, surpassing the signal line—often signaling a long-term trend shift on such a high time frame. However, the RSI struggles to break free of oversold territory below 40—a sign that buyers currently lack the conviction to push the next upwards move. Should buying pressure return and the Ethereum price break back into the triangle pattern, the next major target sits at $2,520—a 40% move from current levels. Institutions’ Favourite Crypto Could Be Boosted By This New ICO Despite institutions favouring Ethereum as the altcoin of voice, Bitcoin remains the go-to cryptocurrency, attracting $675 million inflows during May 2 trading. But, while Bitcoin provides stable gains, it often sacrifices upside potential—that’s where Bitcoin Bull (BTCBULL) comes in, offering a fresh way to capitalize on BTC tailwinds. True to its name, Bitcoin Bull ties its tokenomics to Bitcoin’s price growth in a deflationary model. The project burns tokens and distributes BTC airdrops whenever Bitcoin reaches key milestones—starting at $125,000 and triggering new rewards for every $25,000 climb thereafter. With some analysts forecasting highs of $1M this cycle and BTC finally back on the recovery path, BTCBULL could become a Bitcoin Maxi’s best friend. With over $5.3 million raised in its initial 6 weeks, the project is already gaining strong momentum—potentially credited to its 77% APY on staking that rewards early investors. You can keep up with Bitcoin Bull on X and Telegram , or join the presale on the Bitcoin Bull website . The post Ethereum Price Prediction: Can BlackRock’s ETF Flows Ignite a Rally to $10,000 appeared first on Cryptonews .