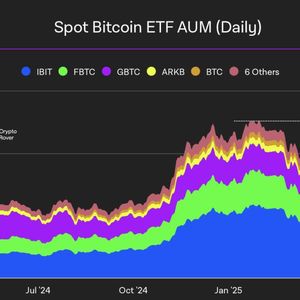

Bitcoin is trading around the $95,000 mark this week—a level that crypto analysts say could determine whether the world’s largest digital asset reclaims bullish momentum or slips into deeper correction territory. At the time of writing, BTC is changing hands at $96,500, posting a modest 3% gain over the last 24 hours, according to CoinMarketCap. Bitfinex, in its latest markets report , called the $95,000 zone a “critical pivot” for Bitcoin, noting it forms the lower boundary of a price range that held from November 2024 through February 2025. A sustained move above it could signal a structural return to bullish conditions and set the stage for a retest of the $109,000 all-time high, achieved in January just before President Trump’s inauguration. But the optimism is tempered. “Failure to hold above $95K could flip the zone into resistance,” Bitfinex warned, opening the door to another leg of corrective downside. The next few trading sessions are likely to be pivotal, as the market decides whether to charge toward new highs or retreat to lower support levels. $98K Could Trigger Bitcoin Short Liquidations As Bitcoin flirts with $97,000, the short sellers are sweating. Crypto analyst Thomas Fahrer flagged $98,000 as the pressure point where nearly $400 million in short positions risk being wiped out. “Send it,” he posted on X, hinting at a possible squeeze that could rapidly accelerate price action. The mood among analysts is cautiously bullish. Back in March, Real Vision’s Jamie Coutts projected a potential top of $123,000 by June under favorable conditions. Swan Bitcoin CEO Cory Klippsten offered a 50% chance for new all-time highs before the month closes. With BTC now inching toward six figures, those projections are being revisited with fresh conviction. Rate Decision Looms, Sentiment Tilts Greedy Adding to the uncertainty is today’s Federal Reserve interest rate decision, a potential volatility trigger that markets will be watching closely. While the CME FedWatch Tool suggests slim odds of a rate cut, even a neutral tone could embolden crypto bulls further. Meanwhile, the Crypto Fear & Greed Index jumped 8 points to 67 in the past 24 hours—firmly in “Greed” territory. Sentiment is rising, and all eyes are on whether Bitcoin can finally crack the $100,000 psychological barrier. The post Bulls Eye Bitcoin $95k Breakout as Shorts Brace for Liquidation appeared first on TheCoinrise.com .