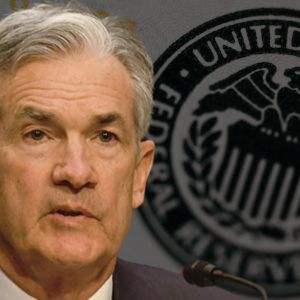

The Federal Reserve will more than likely hold interest rates steady at its May 7-8 policy meeting. Still, all eyes are on Chair Jerome Powell’s comments on the state of the America market, inflation, and the possibility of a recession. Powell will address the press on the Fed’s interest rate decision at 2 PM ET Wednesday. Markets have nearly ruled out any changes to the federal funds rate this week. The CME Group’s FedWatch tool assigns a 97% probability that the central bank will maintain its current target range of 4.25% to 4.50%. After making three cuts in 2024, the central bank has not touched the rate since last December. Investors, economists, and policymakers are waiting for Powell’s remarks in the post-meeting press conference to get clues about how the Fed will help America’s economy. No change expected, but all eyes on Powell According to the first-quarter GDP data released last week, there was a 0.3% contraction in real economic growth, which was not much of a surprise to economists who expected US President Donald Trump’s policies to bring down spending. Yet, April saw a 177,000 nonfarm payroll employment increase that could have given Powell and central bankers more reason to maintain borrowing rates. “ The chaos of U.S. tariff policy leaves the future macroeconomic landscape especially challenging to discern ,” said Erik Weisman, chief economist at MFS Investment Management. Powell, he added, is almost certain to maintain a cautious “wait-and-see” stance. This week’s meeting will be Powell’s first major public appearance since new tariffs introduced by the Trump administration began taking effect. The US president slapped a 145% duty on certain Chinese imports ignoring the cries of retailers who believe the cost of these taxes will be passed on to American consumers. Several analysts like Torsten Slok, chief economist at Apollo, said market expectations are all pointing towards a US-based stagflation. “ Consensus expectations for growth have been revised down, and expectations for inflation have been revised up. This is the definition of stagflation .” The Federal Reserve has so far described the inflation caused by tariffs as “transitory,” meaning it expects price increases to be short-lived. Still, some officials are concerned that inflation expectations could become “unanchored” if the price pressures continue clouding the economy into Q3 2025. Trump piles the pressure on Powell to cut rates President Donald Trump still wants Powell and the central bank to lower interest rates and will certainly want the cut to come in July if not today. CME FedWatch data shows just a 3% chance of a rate cut this week, but the probability increases to about 31% for the Fed’s June meeting and 80% by July. Still, some economists believe rate cuts won’t come until much later in the year. Ryan Sweet, chief US economist at Oxford Economics, said his firm anticipates the Fed will hold rates steady until December, when inflationary pressures may begin to recede and labor market conditions could worsen. Bill English, former senior Fed economist and professor at the Yale School of Management told CBS News that the Fed will not react because “they don’t know exactly how tariffs will impact consumers or businesses.” “I’d be interested to know how Powell is feeling about the balance of risks at this point ,” English added, “ I’d be surprised if he signaled anything strongly either way .” Scott Helfstein, head of investment strategy at Global X, provided an insightful summary of the Fed’s dilemma. “The Fed and investors find themselves in a no man’s land waiting to see whether economic policies drive prices higher and growth lower,” he said. “ There isn’t a good reason to change rates at this point, and the Fed is likely to reiterate the need for more data ,” Helfstein concluded. Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now