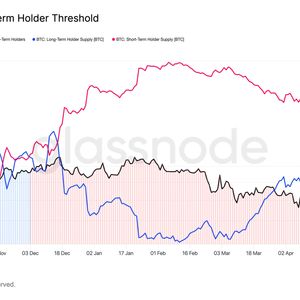

Bitcoin (BTC) is now up 3% since the beginning of May, after gaining 14% gain in April. Inflows into BTC exchange-traded funds (ETFs) have accelerated over the past two weeks, while consistent bitcoin treasury accumulation continues to support the market. From an on-chain perspective, Glassnode data shows that both short-term holders (STHs) and long-term holders (LTHs) have increased their supply holdings, LTHs since early March, while STHs have begun accumulating over the past week. Glassnode defines LTHs as investors who have held BTC for 155 days or more, while STHs have held for less than 155 days. In their latest weekly report , Glassnode notes that LTHs have increased their holdings by over 250,000 BTC, since the start of March, taking the cohort’s total supply to over 14 million BTC. "This suggests a degree of confidence has returned, and accumulation pressures are outweighing the propensity for investors to spend and de-risk,” according to Glassnode. While STHs often act in opposition to LTHs, they too have shown signs of renewed accumulation, adding over 25,000 BTC in the past week. This marks a reversal from the net distribution of more than 200,000 BTC that began in February 2025, coinciding with the onset of bitcoin’s 30% drawdown. With BTC currently flirting with the $97,000 level, this broad-based accumulation indicates a restoration of confidence across investor cohorts. However, Glassnode also identifies a major resistance level at $99,900, where long-term holders may begin to realize profits when they start to hold a +350% unrealized profit margin, according to Glassnode data. “As such, we can anticipate an uptick in sell-side pressure as the market approaches this zone, making it an area that will likely require substantial buy-side demand to absorb the distribution, and sustain upwards momentum". Read more: Massive Bitcoin Bull Run Ahead? Two Chart Patterns Mirror BTC's Rally to $109K