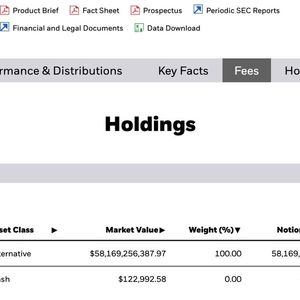

BlackRock's iShares Bitcoin Trust (IBIT) has continued to dominate the Bitcoin ETF market with a consistent inflow streak, reaching 16 consecutive days of net inflows totaling nearly $7 billion in 2025. On May 2 alone, IBIT attracted $675 million, and over the week ending May 2, it bought $2.5 billion worth of Bitcoin. The inflow momentum extended into early May, with IBIT purchasing approximately 5,613 Bitcoin daily, including $531.2 million worth on May 5, bringing its total Bitcoin holdings to over 620,000 BTC valued at approximately $58.5 billion. This accumulation has positioned IBIT as the sixth-largest ETF by year-to-date inflows, surpassing the SPDR Gold Trust (GLD), which recorded $6.5 billion in inflows despite a 23% gain in gold prices compared to IBIT's 4% increase. Meanwhile, other Bitcoin ETFs such as those managed by Fidelity, Ark, Bitwise, and Grayscale experienced outflows or minimal inflows during this period. Ethereum ETFs showed negligible or negative net flows, with no notable inflows recorded. On May 6, Bitcoin ETFs overall saw an outflow of $85.7 million, and Ethereum ETFs had outflows of $17.9 million. The Federal Reserve has also been active in bond purchases, including a $20 billion buy of three-year bonds and a $42 billion purchase of 10-year bonds, which market observers suggest may provide liquidity supportive of asset markets including Bitcoin. BlackRock's continued accumulation amid these market dynamics underscores institutional interest in Bitcoin ETFs despite broader market fluctuations. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io