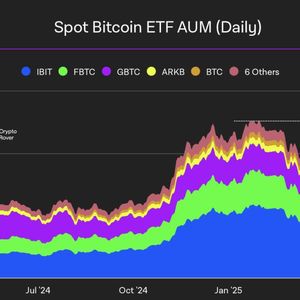

Bitcoin has surged above $104,000, nearing its January record high and adding over 10% in value over the past week. As of press time, Bitcoin ( BTC ) is trading at $104, 325, just 3.79% below its all-time high of $108,786 reached in January. The rally was initially triggered by renewed optimism around a tentative U.S.-U.K. trade agreement teased on May 8 by President Donald Trump, which injected fresh confidence into global markets. Now, a new catalyst is emerging. In a May 11 announcement , the White House revealed that trade negotiations between the U.S. and China have made “substantial progress,” though no official agreement has been finalized. The update came via a joint statement from Treasury secretary Scott Bessent and U.S. trade representative Jamieson Greer, adding anticipation to the market outlook. “I am happy to report that we made substantial progress between the United States and China in the very important trade talks,” Bessent stated. He noted that further details would be disclosed soon, but stopped short of confirming the existence of a finalized deal. Notably, he did not use the word “deal” at all during his remarks. You might also like: Top 3 catalysts for Bitcoin, altcoin prices this week More clarity is expected in the official briefing on May 12, which could serve as a catalyst for Bitcoin’s next leg upward. The crypto market, particularly Bitcoin, has been sensitive to these developments. Prior trade actions, like the tariffs imposed on Canada and Mexico in February and the “Liberation Day” tariffs imposed in April, triggered sharp crypto selloffs, wiping hundreds of billions off the market. Investors seem cautiously optimistic now that the White House has hinted at de-escalation, particularly as Bitcoin tries to break through the $108,000 mark once more. Bitcoin’s most recent gains, meanwhile, show stronger structural support. According to SoSoValue data , spot Bitcoin exchange-traded funds saw more than $1.7 billion in net inflows in the past month, reversing a negative trend that has dominated much of the trade war period. ARK Invest’s April report noted a continued decline in exchange balances, which had reached just 14%, the lowest since 2018, indicating ongoing accumulation. The demand from institutions is still high as well. With no intention of selling, Strategy’s 555,000 BTC holdings are regarded as illiquid, which adds to what CryptoQuant CEO Ki Young Ju refers to as a “-2.23% annual deflation rate” for Bitcoin. Ju wrote on X, “Bitcoin is deflationary,” highlighting how institutional hoarding may cause supply to tighten. Analysts warn that without a clear resolution on trade, sentiment could turn quickly. For now, though, Bitcoin appears to be consolidating on solid ground. If institutional inflows continue and macro conditions improve, the market may be poised for a fresh all-time high. Read more: Coinbase CEO says ‘no’ to Saylor strategy: Why Brian Armstrong passed on the Bitcoin balance sheet bet