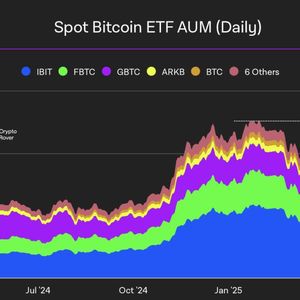

CryptoQuant’s CEO says that Bitcoin is effectively a deflationary asset now that BTC is getting rapidly accumulated by Michael Saylor’s Strategy (MSTR). In a post on the social media platform X, Ki Young Ju tells his 422,200 followers that despite Bitcoin’s inflation, Strategy is now gobbling up coins at a quicker rate than what miners can produce. CryptoQuant’s data appears to show that when excluding coins held by MSTR, the supply of BTC has been going down since late last year. “Bitcoin is deflationary. Strategy is buying BTC faster than it’s mined. Their 555,000 BTC is illiquid with no plans to sell. MSTR’s holdings alone mean a -2.23% annual deflation rate – likely higher with other stable institutional holders.” Source: CryptoQuant/X According to BitcoinTreasuries.net , Strategy has 555,450 BTC worth about $58 billion, representing 2.645% of Bitcoin’s 21 million supply. Ju recently backtracked on his previous call that the Bitcoin bull market was over. The CEO said that Bitcoin’s market structure is more complex now, with many different large players, making forecasting harder. According to the CryptoQuant CEO, selling pressure on BTC has eased in the face of “massive inflows” from spot exchange-traded funds (ETFs). “In the past, the Bitcoin market was pretty simple. The main players were old whales, miners, and new retail investors, basically passing the bag to each other. When retail liquidity dried up and old whales started cashing out, it was relatively easy to predict the cycle peak. It was like a game of musical chairs – everyone tried to cash out at once, and those who didn’t ended up stuck with their holdings. But now, the Bitcoin market has become much more diverse. ETFs, MicroStrategy (MSTR), institutional investors, and even government agencies are considering buying and selling Bitcoin. In the past, profit-taking cycles were triggered when whales cashed out at the peak, leading to a chain reaction of sell-offs and a price drop.” At time of writing, Bitcoin is trading for $114,112. Follow us on X , Facebook and Telegram Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox Check Price Action Surf The Daily Hodl Mix Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing. Generated Image: Midjourney The post Bitcoin Now a Deflationary Asset Amid Aggressive BTC Accumulation by Strategy, According to CryptoQuant CEO appeared first on The Daily Hodl .