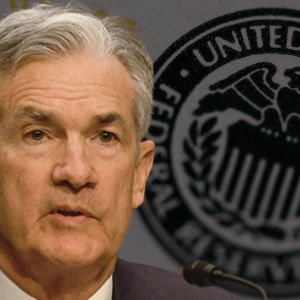

Federal Reserve Chairman Jerome Powell said Thursday that economic trends pointed to the possibility that the Fed will have to grapple with sudden shocks to the supply of goods and commodities in the coming years, which is a difficult challenge for the economy and the central bank. On May 15th, Powell warned that longer-term interest rates were likely to be higher as the economy changed and policy was in flux. He noted that conditions had changed significantly over the past five years, during which the Fed witnessed a period of surging inflation, pushing it to historically aggressive interest rate hikes. The Fed Chair also said that even with longer-term inflation expectations largely aligning with the Fed’s 2% target, the era of near-zero rates was unlikely to return anytime soon. Powell says the U.S. should expect volatile inflation going forward Powell: Higher real interest rates might “reflect the possibility that inflation could be more volatile going forward than in the intercrisis period of the 2010s.” “We may be entering a period of more frequent, and potentially more persistent, supply shocks—a difficult challenge… https://t.co/BqsFOjZbKm — Nick Timiraos (@NickTimiraos) May 15, 2025 According to Powell, higher real rates may reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the 2010s. The Fed held its benchmark borrowing rate near zero for seven years following the financial crisis in 2008. However, the overnight lending rate has been in a range between 4.25%-4.5% since December 2024 and most recently trading at 4.33%. The “supply shocks” remarks were similar to those Powell delivered over the past several weeks, cautioning that policy changes could put the Fed in a difficult balancing act between supporting employment and controlling inflation. “In periods with larger, more frequent, or more disparate shocks, effective communication requires that we convey the uncertainty that surrounds our understanding of the economy and the outlook.” – Jerome Powell , Chairman of the Federal Reserve Powell’s remarks mirrored past concerns, indicating that changes in policy could put the Fed in a difficult balancing act between supporting employment and controlling inflation. Powell warns tariffs could pose a challenge for the Fed The central bank chief previously noted the likelihood that tariffs will slow growth and boost inflation, although he did not mention President Trump in his remarks. However, the extent of the impact was difficult to gauge, particularly as Trump recently backed off the more aggressive duties pending a 90-day negotiating window. Powell said that while he expected higher inflation and lower growth, it was unclear where the Fed would need to devote greater focus as uncertainty over what impact President Donald Trump’s tariffs would have on the U.S economy continued to increase. He added that the Fed may find itself in a challenging scenario where its dual-mandate goals are in tension. If that were to occur, Powell said the Fed would consider how far the economy was from each goal and the potentially different time horizons over which those respective gaps would be anticipated to close. The Fed Chair did not directly say where he saw interest rates headed, but he mentioned that the Fed was well-positioned to wait for greater clarity before considering any adjustments to its policy stance. Powell also said tariffs were likely to move the Fed further away from its goals but noted that survey- and market-based measures of near-term inflation were on the rise, although the longer-term outlook remained close to the Fed’s 2% goal. The Fed Chair claimed tariffs were highly likely to generate at least a temporary rise in inflation, and the inflationary effects could also be more persistent. He pointed out that avoiding such an outcome depended on the size of the effects, how long it took for them to pass through fully to prices, and on keeping longer-term inflation expectations well anchored. Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot