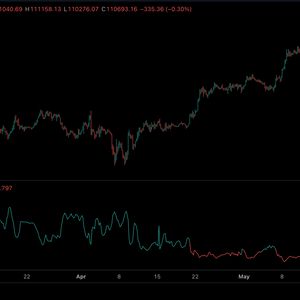

Crypto influencer Anthony Pompliano’s fintech-focused blank-check company, ProCap Acquisition Corp (PCAPU), rose 7% on its debut Nasdaq listing after a last-minute upsizing of its initial public offering. ProCap had boosted its IPO from $200 million to $220 million on May 20, a day before its public launch, pricing its 22 million shares on offer at $10 each. ProCap shares closed the May 21 trading day up 7% at $10.70, which continued with a 1.6% bump after-hours to $10.87, Yahoo Finance data shows. PCAPU’s share price closed up 7% on its debut trading day. Source: Yahoo Finance The company has offered underwriters a 45-day option to buy up to 3.3 million additional shares at the IPO price to cover extra demand. ProCap said in an April 30 regulatory filing that the firm will be a Special Purpose Acquisition Company (SPAC) that will look to invest in, and potentially take public, companies in the financial services, digital asset, asset management or healthcare sectors. Pompliano is one of the crypto industry’s biggest cheerleaders , hosting a Bitcoin and finance-focused podcast and leading investment firm Professional Capital Management. Pompliano told CNBC on May 21 that he had been itching to take a company public over the last five years but hadn’t seen enough demand in the private market until six months ago, citing recent changes to the US regulatory landscape affecting financial markets. Related: Texas House passes strategic Bitcoin reserve bill He hinted that his blank-check firm would invest in crypto-native and traditional finance businesses as he expects the sectors to converge in the coming years. “The reason why I use the term financial services is basically the new digital world and the old incumbent world are all merging.” SPACs haven’t been done right in the past, Pomp says On CNBC, Pompliano was pressed on why he chose to make ProCap a SPAC, which have historically seen high failure rates due to sponsor conflicts, dilution, speculative valuations and regulatory scrutiny. Pompliano said SPACs have gotten a bad reputation because companies often treat them like public venture capital, targeting high-growth companies that are losing a lot of money at high valuations. Pompliano noted he has put “millions of dollars” of his own money on the line. “We’ve got real skin in the game,” Pompliano said, adding: “I’m taking a huge reputation risk.” Brent Saunders, CEO of health products firm Bausch + Lomb, also joined as a strategic adviser . Saunders completed over $300 billion worth of mergers and acquisitions over the last 17 years. Magazine: Danger signs for Bitcoin as retail abandons it to institutions: Sky Wee