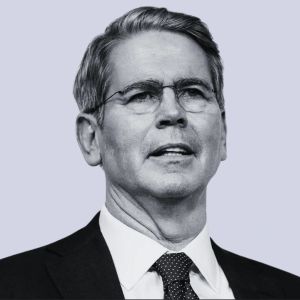

U.S. Treasury Secretary Scott Bessent affirmed that the administration is committed to positioning the country as the global leader in digital assets. Bessent, speaking to Bloomberg, said the government is “going big” on crypto, a striking contrast with the previous administration, which took a restrictive approach that left many companies struggling to survive. In a recent Bloomberg interview, Bessent said that, instead, the White House plans to tighten up anti-money laundering (AML) standards for digital assets, especially stablecoins. He said the administration will pursue strong compliance while encouraging innovation, stating, “Digital asset companies deserve regulatory clarity, and that’s exactly what we are working toward.” Bessent also highlighted one of his key projections that stablecoins will generate $2 trillion in demand for U.S. Treasuries and bills in the near term, far more than the current $300 billion. According to the Treasury Secretary, this shift will inject a lot of liquidity into traditional markets without weakening oversight. Legislative momentum is also building in Washington. A bipartisan stablecoin bill that recently cleared a procedural roadblock in the U.S. Senate could soon become a reality. The measure had been stalled by a filibuster, which the Senate voted to end 66–32 earlier this month, allowing debate on the floor. Key changes to the bill brokered by crypto-supporting Democrats led by Senators Kirsten Gillibrand and Angela Alsobrooks brought the breakthrough. They also dropped demands for a ban on former President Donald Trump profiting from his family’s crypto investments. The legislation marks a pivotal step, but even though a final vote might not take place until after the Memorial Day recess, industry insiders say. If it passes, it will create a clear regulatory framework for stablecoins, ending years of legal limbo and inviting more institutional participation to the industry. Bessent eyes relief for the Treasury market Bessent hinted at heavily transforming the traditional financial system beyond digital assets. He said U.S. regulators are nearing the end of a process that will remove the supplementary leverage ratio (SLR) requirement on banks that trade Treasuries. As a post-2008 crisis safeguard, the SLR currently requires banks to hold more capital against holding trading Treasuries in their reserves. Bessent said that removal could increase liquidity in the $29 trillion market and lower Treasury yields by a few basis points. The Federal Reserve, Office of the Comptroller of the Currency, and the FDIC are in discussions. This would represent a significant regulatory change and may help digital asset markets. Trump’s crypto dinner stirs debate Meanwhile, President Trump is seizing the opportunity to brand himself as crypto’s political champion. In a recent Truth Social post, he said the U.S. is ‘dominating in crypto, bitcoin, etc.,’ vowing to ‘keep it that way.’ The top 220 holders of Trump’s TRUMP meme coin were invited to a high-profile crypto dinner at Trump’s Virginia golf club. Legislators raised concerns about the VIP event’s transparency and its ethical implications. It was reported to have raised $148 million. They questioned the concentration among Trump-linked entities and the risk of foreign influence. Despite the criticism, attendees viewed the dinner as indicative of just how politically relevant crypto is becoming. The White House Press Secretary Karoline Leavitt confirmed that the president was there in his personal time and that no official guest list will be released. Several guests attended with the intent of changing Trump’s stance on crypto regulation, the New York Times later reported. KEY Difference Wire helps crypto brands break through and dominate headlines fast