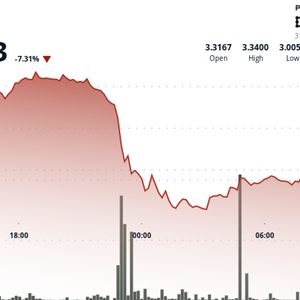

A brutal spike in long-term bond yields is ripping apart one of Wall Street’s most basic investment strategies; the 60/40 portfolio. Investors who rely on the idea that bonds cushion equity losses are now watching both assets sink in tandem. The problem hit hard in May, when 30-year Treasury yields shot past 5%, dragging stock prices down with them. That’s a direct blow to anyone still betting on the old rule that when equities fall, bonds rise. This time, everything’s just falling. The 60/40 model (60% stocks, 40% bonds) had been clawing back relevance in 2025 after years of being dismissed. Through mid-May, the setup was up about 1.6% on the year, beating the S&P 500’s returns while keeping volatility lower. The comeback had one thing going for it: the return of the classic inverse correlation between stocks and bonds. Source: Bloomberg That relationship, for six months straight, was the most negative it’s been since 2021. But that dynamic broke fast. Investors are now looking at a market where rising yields are hammering both asset classes. Yields jump, bonds lose their safety role The selloff in Treasuries is being driven by growing fear around Washington’s out-of-control debt and deficit problem. The surge in yields means prices on long-term bonds are plunging, making them behave more like risky assets than the low-volatility shield investors are used to. “Longer-term Treasuries are behaving like risk assets, not like the typical kind of defensive risk-averse assets,” said Greg Peters, co-chief investment officer at PGIM Fixed Income, during an interview with Bloomberg Television. That shift is wrecking the 60/40 setup, which depends on bonds providing balance. Greg made it clear: if you want to hedge stock exposure, don’t go long. The professionals are pointing toward short-term Treasuries instead, which are still seen as relatively safe and income-generating without the extreme volatility. The uncertainty in fixed income comes as equity markets try to rebound from a rough stretch. On Tuesday, stock futures rose sharply after President Donald Trump said over the weekend that he’d agreed to delay a planned 50% tariff on the European Union. The Dow Jones futures climbed 543 points, or 1.3%, the S&P 500 gained 1.5%, and the Nasdaq 100 popped 1.7%. Trump said he would push the deadline from June 1 to July 9, after a request from Ursula von der Leyen, president of the European Commission. Tariff delay lifts futures, but nerves remain That announcement came after a rough week, where the Dow, S&P 500, and Nasdaq Composite all dropped more than 2%. Trump’s proposed tariffs on the EU — including on Apple products — had been weighing on markets. Monday’s holiday closure for Memorial Day didn’t help the tension. The delay announcement helped cool some fears temporarily, but traders stayed nervous. “We’re still wary about chasing the SPX at these levels given complacency around two major areas of macro risk (tariffs and fiscal policy/yields) along with elevated equity valuations,” said Adam Crisafulli of Vital Knowledge. Adam pointed out that while Trump’s most extreme tariff threats may not actually happen, he’s already introduced serious new import taxes over the past four months. And he’s likely not finished. This week, investors are watching earnings reports closely. Okta is set to release after the bell Tuesday. Reports from Nvidia, Macy’s, and Costco will follow later in the week. FactSet data shows that over 95% of S&P 500 companies have already posted their numbers this season, with nearly 78% beating analyst estimates. But that’s not enough to calm everyone. Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites