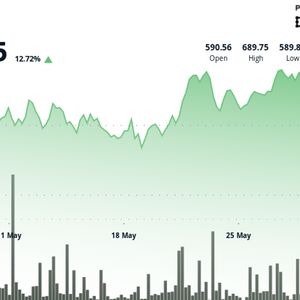

Bitcoin is poised to rally toward $120,000 after a US federal court blocked the majority of President Donald Trump’s tariffs, a crypto analyst says. “The trade court decision was an epic mic drop, and it’s going to intensify momentum behind Bitcoin,” Swyftx lead analyst Pav Hundal told Cointelegraph. The US Court of International Trade reportedly blocked Trump from imposing his tariffs on May 28, arguing that he overstepped his authority. Court “blows a hole in trade talks” Hundal said the decision would have a domino effect on Bitcoin’s price and believes “new all-time highs are imminent, and the momentum is largely irreversible at this stage.” Bitcoin’s ( BTC ) current all-time high of $111,970 was reached on May 22, but it has since fallen to trade around $107,750, according to CoinMarketCap data. Bitcoin is down 3.36% over the past seven days. Source: CoinMarketCap The Trump administration has reportedly filed an appeal to the court’s decision and Hundal said that regardless of whether it presents a new justification for the tariffs, the market sentiment has already changed. “It blows a hole in trade talks either way, and that means we’re likely to witness a significant repositioning in the market.” On April 2, Trump signed an executive order and claimed emergency powers , levying so-called “reciprocal tariffs” on every country starting at 10% . Trump’s initial tariffs on Canada, Mexico, and China, introduced in early February, were widely seen as the primary catalyst behind Bitcoin falling below $100,000 and staying under the psychological level until May 8, as broader macroeconomic uncertainty intensified. “The trade war likely delayed a meaningful greed, rally — but it didn’t bury it. The trend is higher,” Hundal said. BitMEX co-founder Arthur Hayes said , “Buy everything round dos.” Traders ponder “green candles” tomorrow Crypto analyst Bitcoin Ranchy said , “So Trump tariffs are illegal? Does that mean we get green candles all around tomorrow?” Hundal said “a wall of money” is coming into Bitcoin through corporations, spot Bitcoin ETFs and retail. The trading week ending May 23 saw US-based spot Bitcoin exchange-traded funds (ETFs) record a total of $2.75 billion in inflows . Related: Bitcoin analyst says BTC price peak in $220K to $330K range still possible “The court order has just accelerated that rotation into risk assets across the US and Asia,” Hundal said. He added all data signals “a solid floor for demand on spot Bitcoin and a very solid consensus for $120K in the option markets.” Geoff Kendrick, global head of digital assets at Standard Chartered , recently said in an email note seen by Cointelegraph that Bitcoin is expected to hit $120,000 in the first half of 2025 en route to $200,000 by year-end, fueled by the rise of stablecoins. Magazine: Move to Portugal to become a crypto digital nomad — Everybody else is This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.