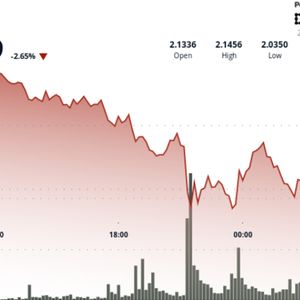

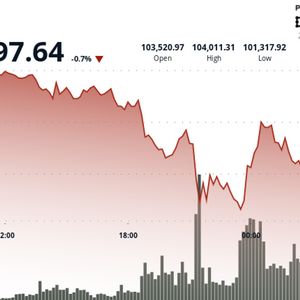

MXC, the native token of the Layer 3 blockchain platform Moonchain, surged as much as 247% recently, thanks to the reactivation of its mining program and a wave of ecosystem updates. According to Coingecko data, Moonchain ( MXC ) reached an intraday high of $0.00525 on the morning of May 29, Asian time, pushing its market cap past $11.6 million. When writing, the token was up 675% from its lowest point this year, marking one of its strongest moves in 2025 so far. MXC crypto also recorded a sharp uptick in trading activity, with daily volume spiking over 500% compared to the previous day, reaching nearly $22.5 million, signalling a flood of new interest and momentum. What’s behind the rally? There are three main catalysts driving MXC’s breakout: First, the Moonchain team officially reactivated MXC mining on its network using MatchX’s M2 Pro and NEO miners, following a temporary outage on May 21. This reactivation also came after a community poll conducted by MatchX on X on May 19, where 97.9% of participants voted in favor of resuming MXC mining. For context, MatchX is a German tech company that builds low-energy mining hardware specifically for the Moonchain ecosystem. Their devices help power Moonchain’s data infrastructure and allow users to earn MXC by participating in its Proof of Participation (PoP) system. Second, Moonchain teased the upcoming launch of its Initial Hardware Offering (IHO). This campaign will send out free physical mining devices, possibly wearables like smartwatches or rings, to Moonchain token holders using an Ethereum smart contract. You might also like: SEC delays Grayscale’s Avalanche and Cardano ETF decisions to July According to the project’s Q2 2025 roadmap, the IHO will also include “health-based” mining devices and limited-edition high-hash-rate models to reward users who lock up their tokens early. Distribution hubs are also being set up in key regions to ensure faster deliveries. Third, Moonchain recently completed an integration with OKX Wallet , a leading multi-chain wallet in the Web3 space. The integration allows users to easily access Moonchain’s dApps, staking features, and token tools across mobile, browser, and Telegram. With OKX Wallet ’s support for over 1,000 protocols, the move better positions both existing and new users to engage with the ecosystem. What Is Moonchain? For those unfamiliar, Moonchain is a Layer 3 blockchain platform that combines AI, IoT, and DePIN (Decentralized Physical Infrastructure Networks). Its native token, MXC, powers transactions within the network, supports an inter-chain NFT marketplace, and rewards participants via its energy-efficient Proof of Participation model. The project also features MXProtocol and is building on Ethereum’s Layer 2 tech, including its own zkEVM , to improve compatibility with existing Ethereum-based apps. This positions Moonchain as a solid pick for developers working on real-world use cases, especially in smart devices and data-sharing networks. MXC price outlook On the technical side, MXC has broken out of a multi-month descending channel, which often signals the start of a potential new uptrend. It also held above the key 61.8% Fibonacci retracement level at $0.0048 before cooling off to around $0.0041 at press time. MXC price, MACD and RSI chart — May 29 | Source: crypto.news Momentum indicators support the bullish case. The MACD lines are crossing upward, and the Relative Strength Index is in the overbought zone, often a sign of sustained buying pressure and strong buyer conviction in an emerging uptrend. However, overbought conditions can also bring short-term selling pressure if traders begin to lock in profits. If MXC continues upward, the next likely target is around $0.0061, a key level it failed to reach in its earlier push. But if it drops below the $0.0030 support, it could slide further down toward the $0.00060 range, which is currently acting as a psychological support zone. Read more: UNI eyes $10 as UniswapX launch triggers inverse H&S breakout Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.