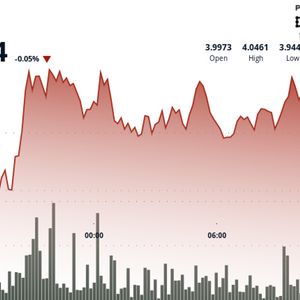

In a historic step that shows deepening faith among institutions in blockchain technology, MemeStrategy, a publicly traded firm on the Hong Kong Stock Exchange (HKEX), has become the very first Hong Kong-listed company to invest directly in the Solana ($SOL) ecosystem. As of this week, MemeStrategy disclosed the acquisition of 2,440 $SOL, with a current value of about HKD 2.9 million (~USD 370,000). This is by far the most substantial investment yet in the Solana ecosystem from a Hong Kong-listed company. BREAKING: @MemeStrategy , a publicly listed company on the Hong Kong Stock Exchange, has acquired 2,440 $SOL worth ~HKD 2.9M — becoming the first HK-listed firm to invest in the @Solana ecosystem. Their stock is up 20% following the announcement. pic.twitter.com/Xq3mLipKbo — SolanaFloor (@SolanaFloor) June 16, 2025 After the announcement, MemeStrategy’s stock shot up 20% in intraday trading. This moves underscores how positive investor response and increasing market interest in blockchain-aligned strategies from traditional firms is translating into MemeStrategy’s stock price. A First for Hong Kong’s Traditional Markets The capital allocated by MemeStrategy to Solana is more than a simple investment; it acts as a bridge between two worlds: our familiar one of traditional finance and the rapidly evolving realm of decentralized networks. Solana has long been recognized by many crypto-native venture firms as an emerging star of the decentralized revolution, but this is a first-in-kind investment for a publicly traded Hong Kong company. By making this move, MemeStrategy has become a trailblazer among companies listed on the HKEX, many of which have been somewhat reticent to adopt digital assets due to regulatory uncertainty. As to why this investment in Solana was made, the official statement from MemeStrategy cited the scalable infrastructure, high transaction throughput, and vibrant developer ecosystem of Solana as the key reasons. This forward-looking move may prompt other local companies to start looking at how they can also gain direct exposure to blockchain technology. That seems all the more possible as the so-called Web3 environment makes inroads to Asia’s financial technology sector. BREAKING: @Solana DApps continue to surpass all other chain DApps in weekly revenue. Top revenue-generating DApps on Solana: • @pumpdotfun : $10.45 million+ • @AxiomExchange : $8.64 million+ • @Phantom Wallet: $3.58 million+ pic.twitter.com/DwWgEQW1eR — SolanaFloor (@SolanaFloor) June 16, 2025 Solana Dominates in DApp Revenue Performance MemeStrategy’s backing comes at a time when Solana is gaining strong forward movement, especially in decentralized applications (DApps). And this isn’t just a perception; Solana-based DApps are consistently outpacing all other blockchain ecosystems (including Ethereum) in terms of revenue generation. And it’s not just the last week or two; the consistency of this trend is what’s really striking. Leading the charge is @pumpdotfun , a OG memecoin launchpad that has pulled in over $10.45 million in revenue. Not far behind is @AxiomExchange , a trading platform with high performance that has netted $8.64 million+. Rounding out the group is the widely utilized @PhantomWallet , which continues to serve millions and has brought in over $3.58 million in weekly revenues. This fast-growing DApp earnings show that Solana is far more than a trading platform. Its burgeoning suite of decentralized applications indicates that it is very much a technological platform with broad utility—merely an app layer atop what looks increasingly like an app ecosystem. This growth in Solana seems to be taking place without (much of) a corresponding price increase in the SOL token. When stacked against Ethereum and other Layer-1 rivals, Solana is able to offer something quite compelling in the blockchain world: low fees and fast transaction processing. Users and developers have been coming to Solana in droves. And for investors like MemeStrategy, those two things—low fees and fast transactions—translate directly into a pretty good value proposition. Institutional Interest in Solana on the Rise MemeStrategy’s investment might be the very first in its kind in Hong Kong, but it aligns with a far larger trend of increasing institutional attention toward Solana. In the past year, we have seen a number of venture funds, crypto hedge firms, and fintech startups either launch Solana-focused products or significantly upsized their treasury allocations to include $SOL. Increased utilization of Solana’s decentralized applications and the infrastructure’s ability to power high-usage, profit-making platforms have made it one of the leading layer-1 blockchains that are still gaining traction. It is suggested by the experts that MemeStrategy’s entry might inspire other firms that are listed publicly to do the same across Asia, particularly within the fintech, gaming, and digital asset spaces. Also, the recent regulatory developments coming out of Hong Kong (where authorities have been on a slow but steady path of opening the digital asset trading and custody frontier) might just catalyze even faster institutional adoption. In the context of a shifting global financial landscape, Solana is a bold bet by MemeStrategy that may very well signal the early stages of a much larger trend: the convergence of publicly traded equity markets and decentralized blockchain ecosystems. MemeStrategy has taken an early opportunity in one of the most rapidly expanding ecosystems of the crypto world. This landmark investment might be remembered as a significant development in Asia’s Web3 evolution. Investor sentiment is improving, and revenues in decentralized applications on Solana are soaring. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !