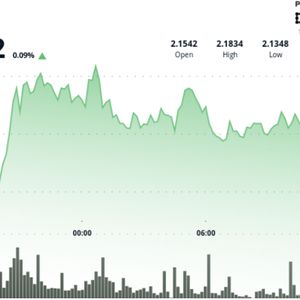

ARK Invest has begun cashing in on its stake in stablecoin issuer Circle just 11 days after the company’s debut on the New York Stock Exchange. The firm, led by well-known Bitcoin supporter Cathie Wood, sold 342,658 shares of Circle (CRCL) on Monday, according to a trade disclosure. The transaction was valued at roughly $51.7 million. ARK Invest Trims Circle Stake After 387% Post-IPO Rally The move marks ARK’s first reduction in its Circle position since acquiring shares during the June 5 IPO. On that day, ARK snapped up around 4.49 million shares, spending $373.4 million based on the closing price. Despite the recent sale, Circle remains one of the top holdings across ARK’s three major funds: the ARK Innovation ETF (ARKK), the ARK Next Generation Internet ETF (ARKW), and the ARK Fintech Innovation ETF (ARKF). Update: Cathie Wood's Ark Invest has sold off $51.7M in Circle shares as the stablecoin company's stock hits a new peak of $151.06. pic.twitter.com/8ZyKeXPAer — Crypto Jessica (@CryptoJessXBT) June 17, 2025 The majority of the trimmed shares came from ARKK, which reduced its holdings by nearly 196,000 shares. ARKW and ARKF followed, selling 92,310 and 53,981 shares, respectively. Combined, the sale accounts for about 7.6% of ARK’s original Circle position. Circle’s stock has surged since going public. It opened at $31 on June 5 and closed at $151.06 on June 16. That represents a 387% gain in less than two weeks. The stock hit an intraday high of $165.60 before easing by the close. At yesterday’s price, ARK’s remaining 4.15 million shares are now worth approximately $628 million, well above its initial investment. The timing of ARK’s partial exit coincides with Circle reaching record highs, suggesting a possible strategy to lock in early profits amid strong market enthusiasm. Still, the asset manager maintains substantial exposure to Circle. ARKK holds the largest slice, valued at $387.7 million and making up 6.6% of its portfolio. ARKW and ARKF follow closely, each holding over 6.7% of their portfolios in CRCL. Neither ARK nor Wood has commented publicly on the sale. However, the rapid rise in Circle’s valuation raises questions about whether ARK is simply securing gains or taking a cautious approach after a steep rally. Circle’s listing and the sharp increase in its stock price have brought renewed attention to tokenization and digital asset firms entering public markets. With this sale, ARK shows it’s willing to move quickly when the numbers align. Circle’s IPO Frenzy Draws Big Players as Shares Soar 160%—But Is the Momentum Sustainable? Circle Internet Financial, the issuer of USDC, made a blockbuster trading debut on the NYSE on June 5 , with shares opening at $69.50, more than doubling its IPO price of $31. The 124% surge marked one of the most dramatic post-IPO rallies of 2025, briefly pushing Circle’s valuation to over $8 billion fully diluted. The offering raised $1.05 billion, with 34 million shares sold , 14.8 million by Circle itself and the remaining 19.2 million from existing shareholders. It followed a last-minute upsizing of the deal from 24 million to 32 million shares, driven by overwhelming demand that saw books close more than 25 times oversubscribed. Major financial institutions were quick to back the listing. BlackRock is reportedly acquiring roughly 10% of the shares , strengthening its existing ties to USDC through its management of the stablecoin’s cash reserves. BlackRock is reportedly planning to purchase around 10% of the shares offered in @Circle upcoming IPO according to a Bloomberg report. #USDC #Circle https://t.co/yabSKAOV47 — Cryptonews.com (@cryptonews) May 28, 2025 Ark Invest also made headlines by revealing plans to buy up to $150 million worth of shares at IPO . The excitement comes after Circle’s months-long preparation for a traditional listing, following the SEC filing of its Form S-1 earlier this year. Citi and JPMorgan served as lead underwriters for the deal . However, with Ark Invest selling $52 million worth of shares just 11 days post-IPO, questions are already emerging over whether the rally was driven more by hype than fundamentals. Investors are now watching closely to see if Circle can sustain this momentum, or if the sell-off signals early doubts about its long-term growth story. The post ARK Invest Sells $52M in Circle Shares Just 11 Days After IPO—Profit-Taking or Red Flag? appeared first on Cryptonews .