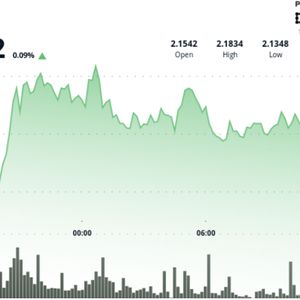

Coinbase has signed a deal to use USDC as collateral in US futures trading, pushing the stablecoin deeper into mainstream financial markets. The announcement came on Wednesday through the company’s website. Coinbase Derivatives, a subsidiary of the exchange, will partner with Nodal Clear, a clearinghouse, to get regulatory approval for the first use of a regulated stablecoin as margin collateral in crypto futures. The issuer of USDC is Circle, which has a $61.5 billion market cap, according to data tracked by CoinGecko. Coinbase holds a minority stake in Circle, and it also offers easier options for e-commerce merchants to integrate USDC for purchases. Shopify confirmed it’s rolling out USDC payment options on its platform last week. Coinbase pushes for stablecoin collateral as Senate passes stablecoin bill The new collateral plan follows the US Senate’s Tuesday vote to pass a bill regulating stablecoins like USDC . The bill isn’t law yet, but it’s expected to be finalized in the coming weeks. The regulation is expected to help tokens like USDC gain more trust from institutions that deal in traditional financial instruments. Traders already rely on stablecoins during periods of volatility. What changes now is who’s allowed to use them. Stablecoins are already used heavily in DeFi, especially for lending and borrowing. In 2023, one of the CFTC advisory panels proposed that blockchain-based assets like stablecoins should count as non-cash collateral. This is now becoming real. Coinbase has been building its derivatives wing since 2022, when it bought FairX, a US futures exchange. By 2023, it had already secured federal approval to offer crypto derivatives to retail customers in the US Nodal Clear, its new partner, handles all the clearing services for both Coinbase Derivatives and Nodal Exchange. The announcement triggered a rally, as Coinbase stock jumped by about 17%, peaking at $296.46 as markets responded to the expanding role of stablecoins in regulated environments. Circle’s IPO explodes as fintech giants and retailers join stablecoin race While Coinbase was making headlines, Circle’s stock was on a run of its own. Trading under CRCL, the stock soared 34% to close at $200, then gained another 5% after-hours to hit $208. This happened less than two weeks after its IPO. At that point, shares were worth seven times their initial offer price. Wall Street reacted fast, with some investors stunned at the speed of the gains. The flood of interest points to a wider belief that stablecoins will soon dominate large parts of finance. Financial giants like PayPal, Banco Santander, and Deutsche Bank have already dipped into stablecoins. Visa and Stripe have upgraded their tech stacks to support them. Merchants aren’t sitting on the sidelines either. Some of the largest US companies are exploring ways to issue their own coins. Amazon and Walmart have had internal talks about launching their own US-based stablecoins, as reported by the Wall Street Journal. The paper said unnamed people familiar with the discussions provided the details. The appeal is obvious. With stablecoins, businesses can cut down transaction fees, speed up settlement times, and operate outside traditional banking hours. They work 24/7 and don’t depend on clearing times or bank holidays. The market is growing fast. In April, analysts at Citigroup Inc. projected the total supply of stablecoins could hit $3.7 trillion by 2030. That estimate assumes continued adoption, favorable policies, and more integration with legacy finance. But if regulation drags or fraud and security risks creep in, the number could stay closer to $500 billion—still double what it is today. Most of the current usage of stablecoins is still within crypto ecosystems. In February, almost $4 trillion in stablecoin transactions were recorded, based on data from Allium Labs and Visa. But only $6 billion of that was actually categorized as payments. The rest was internal crypto trades, but that gap might close as more companies adopt stablecoin payments. By the time of publication, the total market capitalization of stablecoins reached a record high of $251.7 billion, up 22% year-to-date, according to data from CoinGecko. KEY Difference Wire : the secret tool crypto projects use to get guaranteed media coverage