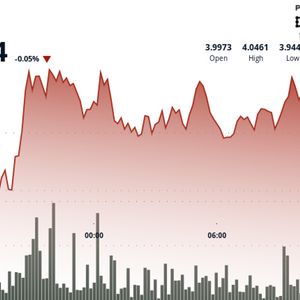

Circle’s stock surged 34% on June 18 to close at $199.59 after the GENIUS Act cleared the Senate. According to Yahoo Finance data , the stock briefly touched an all-time high of $200.90 before closing at $199.59. The move marked a nearly 6.5-fold increase from the company’s initial public offering price of $31 set two weeks earlier on June 5. The sharp rally came just after the U.S. Senate passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, a bill that would establish a comprehensive federal framework for regulating dollar-backed stablecoins such as Circle’s USD Coin ( USDC ). The legislation, which cleared the Senate with a 68–30 vote on June 17, now heads to the House of Representatives. House Financial Services Committee staff confirmed that scheduling discussions are expected to begin next week, although a floor vote date has not yet been announced. Supporters of the bill hope to have it on President Donald Trump’s desk before the August congressional recess. You might also like: GENIUS Act could bring trillions in institutional crypto capital: experts weigh in Alongside Circle’s gains, Coinbase’s stock increased by 14%, and Robinhood’s stock rose by 4.5% to reach a new all-time high of $78.35. The market reaction reflected growing confidence that clear federal oversight of stablecoins could accelerate mainstream adoption and de-risk the regulatory landscape for U.S.-based issuers. The GENIUS Act creates federal licensing requirements for stablecoin issuers, mandates complete backing of tokens with dollar reserves, such as cash or Treasuries, and gives the Federal Reserve and the Office of the Comptroller of the Currency oversight powers. The legislation also seeks to improve technical interoperability among blockchain platforms and standardize consumer protection guidelines. While some states, like New York, already regulate stablecoins through local regimes like BitLicense, the GENIUS Act aims to bring all of those efforts together under a single national standard. The Act enhances Circle’s standing as a top U.S. issuer with institutional-grade practices, as it already complies with strict reserve transparency and compliance standards. USDC, Circle’s primary product, is currently widely used in decentralized finance, remittances, and tokenized payment systems. Read more: What happens on day one after the GENIUS Act passes? | Opinion