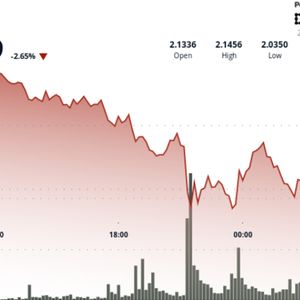

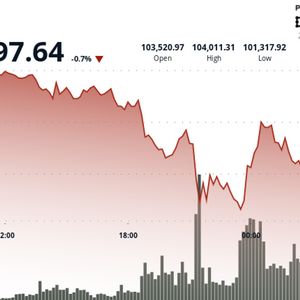

Recent market movements have caused a significant drop in the prices of Chainlink (LINK) and Ondo (ONDO) , but savvy investors see potential in this temporary dip. These digital assets, known for their innovation and utility, are poised for a rebound. Discover why this downturn may be the perfect time to invest in these promising cryptocurrencies. Chainlink Trends and Key Levels Signal Cautious Trading Outlook Over the last month, Chainlink dropped around 21% as selling pressure increased. Over the past six months, losses reached nearly 42%, reflecting a strong bearish trend in the market. The price trajectory has consistently trended downward, indicating that negative sentiment has weighed on the coin for a prolonged period. Past performance shows that market conditions have posed significant challenges for Chainlink, with recurring declines highlighting uncertainty in investor confidence. Chainlink is currently trading between $12 and $16, with immediate resistance at $19 and further potential at $24. Support levels are at $10 and around $5, framing key trading zones. Technical indicators depict a bearish outlook with a negative momentum of -2.18 and an Awesome Oscillator reading of -1.41. The RSI at 39 indicates oversold conditions. Bulls seem sidelined, and the overall trend lacks a clear recovery signal. Trading opportunities may arise if the price holds at support levels, but caution is vital as breaks below could lead to further declines. Ondo Price Snapshot Amid Altcoin Season and Global Bull Outlook Recent performance reflects a sharp decline, with a one-week drop of 6.81% and a one-month fall of 23.82%. The half-year performance shows a significant decrease of about 54.05%. These numbers indicate a consistent downward movement in recent periods. The price behavior portrays a market that has struggled to recover, with traders witnessing a steady deterioration and clear corrections over time. The shifts in price have been considerable, signaling a need for cautious observation as market dynamics continue to evolve. Current price levels range from $0.70 to $1.05, with resistance at $1.27 and support at $0.57. A secondary barrier exists at $1.62, while another support level is noted at $0.21. Indicators like the Awesome Oscillator and Momentum Indicator near -0.100 and -0.123 suggest active selling, reinforcing a bearish sentiment. The Relative Strength Index at 37.25 hints at potential oversold conditions but does not confirm a strong rally. Trading ideas may focus on short-term pauses at $0.57 or potential reversal signs if the price breaches $1.27. With bears dominating and volatility high, any move above key resistance could signal a cautious entry for bulls aiming to restructure the current downtrend. Conclusion Recent drops in LINK and ONDO prices present a unique buying opportunity. Both coins have strong fundamentals and a promising future. These sell-offs are likely temporary and may offer gains for those who act quickly. Investors should consider the long-term potential of these cryptocurrencies. The current dip in prices should not overshadow their growth prospects. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.