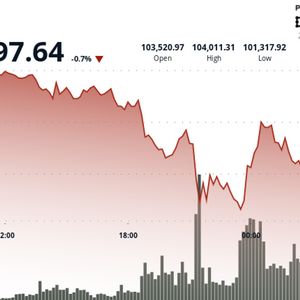

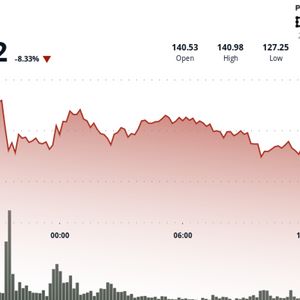

Bitcoin (BTC) BTC rallied above $102,000 after briefly falling below $101,000 in a volatile session marked by unusually heavy trading, according to CoinDesk Research's technical analysis model. Market participants reacted swiftly to the dip, which pushed BTC near the bottom of its month-long trading range. The reversal gained momentum as volume accelerated, leading to a strong rebound. The move coincided with a sharply worded post from James Lavish, a Managing Partner of the Bitcoin Opportunity Fund, who wrote on X : “If you are selling Bitcoin because of the possibility of the world going to war, you have absolutely no idea what you own.” The $100K–$110K range has contained price movement for nearly a month. On-chain metrics suggest a balanced market with neither excessive profit-taking nor aggressive accumulation, while derivatives data indicates cautious sentiment with continued demand for downside protection. Technical Analysis Highlights A midnight push lifted BTC above $102,800 with trading volume peaking at 17,906 BTC. Between 05:57 and 06:00, BTC climbed from $102,767 to $102,912, supported by volume spikes over 150 BTC per minute. Peak recovery-period volume hit 184.24 BTC, helping drive price toward $102,990. Minute-level consolidation around $102,680–$102,720 preceded the breakout. A higher support level began forming near $102,870 as volatility decreased. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .