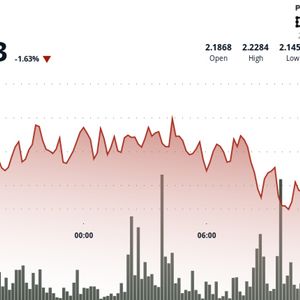

The cryptocurrency market turned green over the past 24 hours from 24 June 15:00 to 25 June 14:00, with the global market cap increasing by 2.2% to $3.37 trillion. NEAR Protocol showed resilience during this period despite experiencing sharp price swings, establishing support at $2.14-$2.16 with high-volume buying emerging at critical points. In a significant development for NEAR's economic model, a proposal has been put forward to cut the protocol's inflation rate from 5% to 2.5%. This strategic move aims to enhance long-term blockchain sustainability, potentially boost token value, and better align ecosystem incentives. The proposal is currently subject to validator voting through the end of July 2025, demonstrating NEAR's commitment to decentralized governance. Technical Analysis NEAR-USD exhibited significant volatility during the 24-hour period from 24 June 15:00 to 25 June 14:00, with an overall range of $0.088 (4.0%). A sharp decline to $2.141 at 09:00 before recovering formed a key support zone around $2.14-$2.16. High-volume buying emerged at the 08:00-09:00 candles (volumes of 2.99M and 2.53M respectively, well above the 24-hour average). Resistance established near $2.22-$2.23 throughout the trading session. The 13:00 candle showed renewed bullish momentum with above-average volume (2.80M), suggesting potential continuation of the recovery trend. During the last 60 minutes from 25 June 13:06 to 14:05, NEAR-USD exhibited a bullish surge followed by a sharp correction. The price rallied from $2.17 to peak at $2.19 around 13:48-13:49, gaining approximately 1.2%. Notable volume spikes occurred during the uptrend (131,699 at 13:44) and during the correction (130,287 at 13:51). The price action formed a clear channel pattern with higher lows until the correction, suggesting continued consolidation.