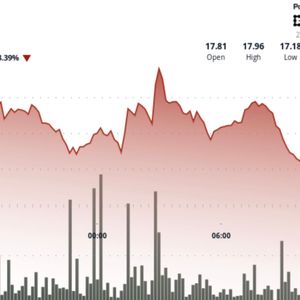

The dollar lost ground fast on Thursday after The Wall Street Journal reported that Trump might reveal his next Federal Reserve chair pick much earlier than expected. Traders responded immediately in Asia as the US currency dropped against all its major peers. The news came after Trump said he’s unhappy with how current Fed Chair Jerome Powell has handled interest rates, believing he’s been too slow to cut them. Source: Bloomberg Trump is now considering making an announcement as early as September or October, while Powell’s term doesn’t end until May 2026. According to the Journal , the names being floated inside the White House include Kevin Warsh, a former Fed governor, and Kevin Hassett, the director of the National Economic Council. Both men have had previous ties to Trump’s circle, and the idea of naming a successor so early is already shaking investor confidence. Trump told reporters Wednesday he’s currently considering “three or four” potential replacements. He’s openly criticized Powell’s recent decision to keep interest rates on hold, saying it’s keeping government borrowing costs high and hurting growth. Earlier this month, he said new names would be coming “very soon.” White House sends mixed signals Rodrigo Catril, strategist at National Australia Bank in Sydney, said Trump’s possible early announcement could “amp up the pressure” on Powell long before his term ends. “We could have a shadow Fed chair before May next year,” Catril said, adding that this kind of political pressure could push the dollar lower in coming weeks. When asked about Trump’s intentions, the White House responded by saying the Fed should focus on growth-oriented monetary policy. Powell, for his part, insisted politics wouldn’t influence the Fed’s choices. “If we make a mistake here, people will pay…the cost for a long time,” Powell told lawmakers during a Senate hearing. He added that rate cuts are still possible later this year, but said the Fed would take a “careful approach.” On the timeline, Larry Bessent, current Treasury Secretary, previously said interviews for the next chair wouldn’t begin until September. But that schedule might not hold. The Fed’s independence has been guarded since the 1970s, when President Nixon pressured the central bank for lower rates ahead of his reelection. That led to disastrous inflation that took years to fix. Trump eyes Warsh, Bessent, and Malpass for top role Trump has had Warsh on his radar for a while. He spoke with him earlier this year about possibly replacing Powell before his term ends. Warsh was also interviewed by Trump last fall for the Treasury job. At a closed-door event in Boston this month, Warsh told a group of finance professionals, “I wouldn’t be shocked if the president made a nomination sooner than would be customary, just to…try to make a lame duck lamer or something like that.” Still, there are concerns. Some of Trump’s aides worry Warsh could be a maverick. He’s long been seen as a policy hawk, more focused on fighting inflation than boosting employment. When asked about that label in Boston, Warsh said, “My fatal flaw is I say what I believe. If the president wants someone who is weak, I don’t think I’m going to get the job.” He also took a shot at zero interest rates: “When things are free, when rates are zero, that leads to very bad economic outcomes.” Warsh also praised Kazuo Ueda, head of the Bank of Japan, saying he’s “the most talented central banker on the planet right now.” Then there’s Hassett, who’s reportedly told people he’s not interested in taking the job. That makes room for Bessent. Despite saying he’s committed to his current position, people familiar with both him and Trump say Bessent hasn’t ruled it out. Speaking before Congress earlier this month, Bessent said, “I’m happy to do what President Trump wants me to do.” That loyalty matters—Trump barely knew Powell when he picked him in 2018 and now sees that decision as a mistake. He’s determined not to repeat it. Trump has also been talking to aides about David Malpass, who ran the World Bank during his first term. Malpass has recently supported rate cuts and criticized the Fed’s internal models in a Journal op-ed. Those views line up with Trump’s. But in recent private dinners and lunches, Trump reportedly raised doubts over Malpass’s TV appeal, suggesting his appearance might not suit the role. KEY Difference Wire : the secret tool crypto projects use to get guaranteed media coverage

![[LIVE] Pi Coin Price Prediction: Chainlink–Mastercard Hype Fuels Huge Rally – Is This the Start of Mass Adoption? [LIVE] Pi Coin Price Prediction: Chainlink–Mastercard Hype Fuels Huge Rally – Is This the Start of Mass Adoption?](https://resources.cryptocompare.com/news/52/46828832.jpeg)